Black teachers: How to recruit them and make them stay

Lessons in higher education: What California can learn

Keeping California public university options open

Superintendents: Well-paid and walking away

The debt to degree connection

College in prison: How earning a degree can lead to a new life

The school year has gotten off to an exciting start for Kennedy High Digital Arts teacher Mitzi Perez, who with her fiancé recently moved into their first home in the district where she teaches, during the same week she welcomed new students into her classroom.

They bought the $510,000 house in Richmond in the East Bay with down payment money lent to them through a state program for school employees. They also got a small grant toward closing costs and counseling from local programs.

Perez is one of about 2,400 school employees statewide over the past 17 years who got down payment loans through a state program for teachers and other K-12 school employees.

In addition to the $17,850 down payment loan, Perez and her fiancé Anthony Caro obtained a 30-year CalPLUS conventional mortgage for $492,150 at about 4.6 percent interest through the same state agency. They also got a smaller Zero Interest Program loan, known as a ZIP loan, for about $20,000 that helped pay for closing costs. All told, the assistance totaled about $530,000, including the mortgage.

“I’m a little speechless,” said Perez, 23, after signing the final loan documents late last month. “I feel very fortunate — super fortunate. I couldn’t be any more happy!”

The down payment loan was provided by the California Housing Finance Agency’s School Teacher and Employee Assistance Program, known as the “CalHFA School Program,.”

Perez is starting her second year as a teacher in the West Contra Costa Unified district that includes Richmond and surrounding communities. She and Caro would have had to rent for several more years to save up for the down payment and closing costs if they hadn’t qualified for the state loans, she said.

Districts across California are struggling to cope with the impact of the state’s hot housing market on their employees. West Contra Costa Unified is like many school districts across the state hoping to improve teacher recruitment and retention by exploring options or partnerships that could help teachers find homes within the districts where they work. Some are building housing — an idea that West Contra Costa is also exploring. Others are making employees aware of regional down payment and closing cost assistance programs that could benefit them.

Although housing in Richmond is less expensive than in nearby communities such as Berkeley and San Francisco, Perez and Caro also needed to have her parents co-sign for the mortgage. Perez, who makes about $50,000 a year, and Caro, founder and CEO of a local nonprofit called the Citizen’s Power Network, which educates students on the importance of voting and civic engagement, would not have had enough money to purchase their first home without the assistance.

The house was built as part of a Richmond Community Foundation home renovation program, which aims to help first-time homebuyers such as teachers to live in the city where they work. Jim Becker, executive director of the foundation, said his organization is especially interested in bringing teachers and other school employees into the program.

The foundation’s program includes a first-time homebuyer orientation through the nonprofit SparkPoint Center, created by the United Way of the Bay Area as one of several regional financial education centers that help local residents set up budgets.

“Part of the challenge that we have as a community is finding housing for people who actually work here, and teachers are a big part of that workforce,” Becker said.

Theresa Harrington/EdSource Today

Jim Becker, left, executive director of the Richmond Community Foundation, speaks to West Contra Costa Unified teacher Mitzi Perez and her fiancé Anthony Caro inside their new home, which was built through a program funded by the foundation.

Statewide, the housing program is helping teachers in communities such as West Contra Costa, where it is still possible to buy a single family home costing less than $710,000 — the maximum loan amount.

Marcus Walton, spokesman for West Contra Costa Unified, said the high cost of housing is “one of the biggest barriers to our ability to recruit and retain teachers.” The district’s school board recently approved salary raises amounting to 17 percent through 2020 — which include a 5 percent raise that began in March — putting West Contra Costa teachers among the highest paid in Contra Costa County. Even so, Walton said “the cost of housing continues to rise.” And even the pay hikes may not cover the housing costs teachers face.

“This is not something the district can solve alone,” Walton said. “We need the help of our partners to ensure that West Contra Costa Unified is considered a desirable place to work and live.”

To help employees understand their options, the district held a housing fair last spring and partnered with the startup Landed, which lends funds for a down payment that is repaid when the home sells including a percentage of profit or loss.

Ensuring that the district’s employees have information about the state and local programs “is an important component of our ability to attract and retain teachers and a high-quality workforce,” Walton said. The state program can be used with other local programs to help school staff afford a home, he added.

Although the state’s housing finance agency has offered school employee loans since 2001, many people still don’t know about them, said Eric Johnson, the agency’s spokesman. The School Program, which until recently was known as the “Extra Credit Teacher Home Purchase Program,” provides low-interest deferred loans to first-time home buyers with combined household incomes of $118,000 to $228,300 — depending on the county in which they live. As deferred loans, they are repaid when the buyer sells or refinances the home.

The state program assistance has been concentrated in the Central Valley of the state, as well as the Sacramento area and Riverside county in Southern California, where housing costs are generally lower than in the Bay Area, Johnson said. Statewide, the number of School Program loans disbursed dropped to none during the 2008 recession, but then began picking up steam in 2015, he added.

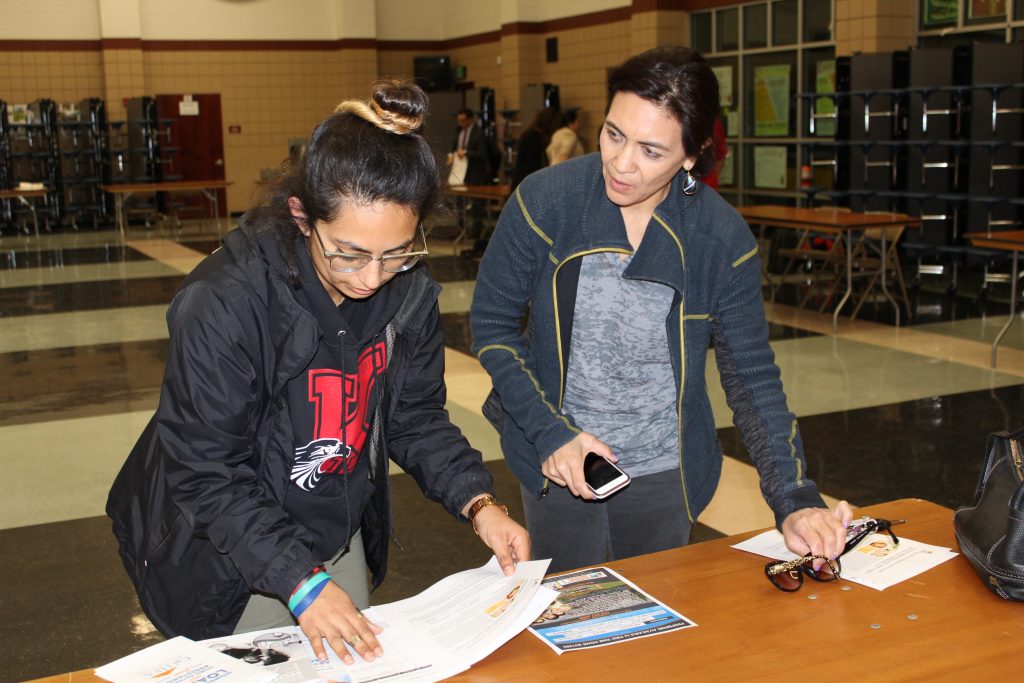

Theresa Harrington/EdSource Today

West Contra Costa school district employees discuss housing assistance with a representative from the California Housing Finance Agency at a district housing fair on April 16, 2018.

“Mitzi and Anthony were in desperate need of down payment assistance,” said Nicki Beasely, executive director of the nonprofit Richmond Neighborhood Housing Services, adding that her organization wants to work with school employees in Contra Costa and Alameda counties.

“We have a pipeline of teachers that we’ve been engaged with,” she said. “But Mitzi will be the one teacher we’ve helped get approved this year.”

Nikki Lowy, spokesperson for Landed, the start-up that offers down payment assistance, said her organization has provided 10 percent down payment loans to about 100 school employees, including about 95 in California and five in Colorado.

Of those in California, about 80 are in northern California and the rest are in Los Angeles, Orange or San Diego counties.

Landed recently announced it is teaming up with the College Football Playoff Foundation and the Bay Area Host Committee to offer teachers and other school employees financial coaching and down payment assistance.

Theresa Harrington/EdSource Today

Kennedy High School teacher Mitzi Perez, left, reviews information from the West Contra Costa Unified housing fair with Downer Elementary teacher Diana Ortega, right. Perez, who recently purchased a home through the CalHFA School Program, has been sharing details about how she qualified to buy her house with other interested teachers.

Perez said she is also spreading the word about housing resources to her fellow teachers, who have been congratulating her on her new home and asking, “Hey, how’d you do it?”

“I try to help as many teachers as I can who come by and ask about it,” she said. “I’m very humbled by this experience.”

Editor’s Note: As a special project, EdSource is tracking developments this year in the Oakland Unified and West Contra Costa Unified School Districts as a way to illustrate some of the most urgent challenges facing many urban districts in California. West Contra Costa Unified includes Richmond, El Cerrito and several other East Bay communities.

The overreliance on undersupported part-time faculty in the nation’s community colleges dates back to the 1970s during the era of neoliberal reform — the defunding of public education and the beginning of the corporatization of higher education in the United States. Decades of research show that the systemic overreliance on part-time faculty correlates closely with declining rates of student success. Furthermore, when faculty are… read more

Panelists discussed dual admission as a solution for easing the longstanding challenges in California’s transfer system.

A grassroots campaign recalled two members of the Orange Unified School District in an election that cost more than half a million dollars.

Legislation that would remove one of the last tests teachers are required to take to earn a credential in California passed the Senate Education Committee.

Comments (7)

Comments Policy

We welcome your comments. All comments are moderated for civility, relevance and other considerations. Click here for EdSource's Comments Policy.

Lynda G Detweiler 2 years ago2 years ago

We are a NPA and could use some additional information for our teachers that are based in San Diego North County specifically Encinitas, California. Please advise

James David 3 years ago3 years ago

Another housing finance entity in California also provides down payment assistance (DPA) to teachers in California. Through the GSFA Platinum Program, current members of the California State Teachers Retirement System or University of California Retirement Plan, employees of a California accredited private, charter or public school district or California State University, Junior College or Private College, including school administration and staff, are eligible for a down payment assistance GIFT, up to 5 per cent of … Read More

Another housing finance entity in California also provides down payment assistance (DPA) to teachers in California. Through the GSFA Platinum Program, current members of the California State Teachers Retirement System or University of California Retirement Plan, employees of a California accredited private, charter or public school district or California State University, Junior College or Private College, including school administration and staff, are eligible for a down payment assistance GIFT, up to 5 per cent of the first mortgage loan amount. The down payment assistance gift never has to be repaid through the GSFA Platinum Program.

Mariela Cuellatlr 6 years ago6 years ago

Congratulation Mitzy and to all the teachers who have accomplished this goal and dream to have their own home. This is great information.

I would like to ask if this home assistant programs apply to all teachers from traditional and charter schools. What is the process? I would like to get information to share it with teachers in general, no matter what school they are teaching. Please let me know.

Carolyn Sunseri 6 years ago6 years ago

Golden State Finance Authority, another housing finance entity in California, also provides down payment assistance (DPA) to teachers in California. Through the GSFA Platinum Program, current members of the California State Teachers Retirement System or University of California Retirement Plan, employees of a California accredited private, charter or public school district or California State University, Junior College or Private College, including school administration and staff are eligible for a down payment assistance GIFT, up to … Read More

Golden State Finance Authority, another housing finance entity in California, also provides down payment assistance (DPA) to teachers in California. Through the GSFA Platinum Program, current members of the California State Teachers Retirement System or University of California Retirement Plan, employees of a California accredited private, charter or public school district or California State University, Junior College or Private College, including school administration and staff are eligible for a down payment assistance GIFT, up to 5 percent of the first mortgage loan amount. The down payment assistance gift never has to be repaid through the GSFA Platinum Program. You can find out more information online at http://www.gsfahome.org or call (855) 740-8422.

It is important that homebuyers know there are several options for assistance.

david 6 years ago6 years ago

Sounds to me like the state has figured out a way to financially bury these poor teachers, make them beholden to the state.

Anes 6 years ago6 years ago

So true. There is no way a new teacher will be able to afford a $3,500 with the current teacher pay. The solution should be to lessen the teacher’s burden not a high mortage and high debts. Please give more details and shade a light between the lines.

Brady Bernhart 6 years ago6 years ago

Depending on taxes and insurance and mortgage insurance this loan will be between $3,500 and $3,800 a month! Please write an article explaining how a teacher can make these kind of payments? Does her spouse make enough to support this?