Black teachers: How to recruit them and make them stay

Lessons in higher education: What California can learn

Keeping California public university options open

Superintendents: Well-paid and walking away

The debt to degree connection

College in prison: How earning a degree can lead to a new life

Besides voting for a new state superintendent of public instruction, voters in dozens of school districts in California on Tuesday decided whether to borrow money for school construction projects and tax themselves.

With all precincts reporting but not all ballots counted, voters passed school construction bond measures in 89 of 112 K-12 and community college districts. And they passed parcel taxes in eight of the 13 school districts that had placed them on the ballot to create new sources of revenue or to extend existing parcel taxes.

Michael Coleman, the creator of the online California Local Government Finance Almanac and principal fiscal policy adviser to the League of California Cities.

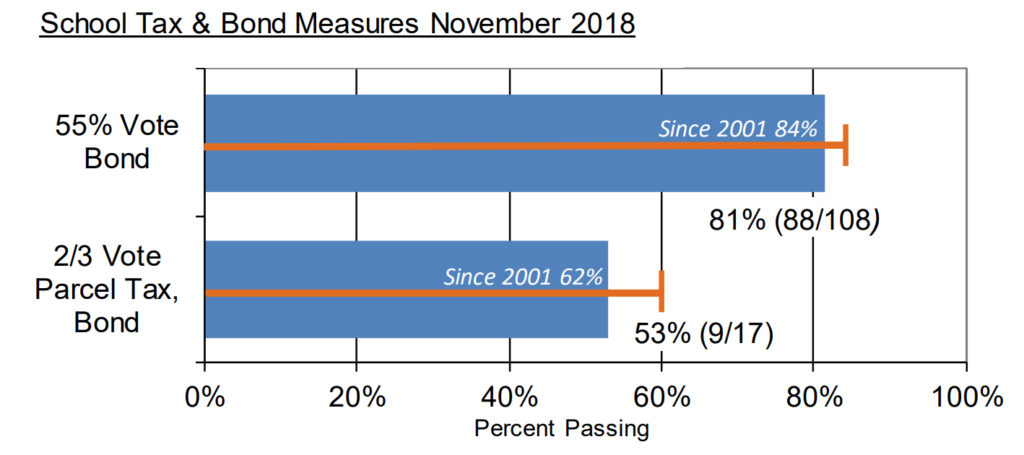

Voters have historically passed 84 percent of school bonds requiring a 55 percent majority, according to Coleman. The tentative passage rate on Tuesday is 81 percent.

On school taxes, voters have historically passed 56 percent of the parcel taxes, according to Coleman. Last November, 10 out of 13 parcel taxes were approved, a higher rate than average (see page 14).

But the final results could change in 10 districts where the results were within 2 percentage points above or below 55 percent or 66.7 percent. An estimated 4 million votes remain to be counted statewide in addition to the 7.3 million votes that have been counted. The bulk is mail-in ballots that were dropped off at a polling place or put in the mail on Election Day.

More than $15.7 billion worth of construction bonds were on the ballot, with $14.8 billion approved. Eighty-eight of the 108 bond measures that needed at least a 55 percent majority for passage were approved. In four districts where high bond indebtedness levels required a two-thirds majority for approval, only one bond appeared to pass, though barely: a $10 million bond, approved by 66.8 percent of voters in the one-school Luther Burbank School District in San Jose to replace the main school building.

The largest bond issue was the $3.5 billion bond issue in San Diego Unified, the state’s second largest district, which passed with 61 percent of the vote. It will include renovations to improve school security, upgrade labs and fix plumbing to remove lead in drinking water along with setting aside $588 million for charter school facilities. Voters in the Monroe Elementary School District in Fresno County passed the smallest bond issue, $1 million to replace leaky roofs and modernize classrooms and bathrooms, with 76 percent of the vote.

The list of districts that passed bonds (pages 14-16) underscores the vast differences among districts’ taxing capacity to build and renovate schools, based on underlying property wealth. Because of the value of homes and business properties in Silicon Valley, a homeowner in Santa Clara Unified will pay $50 per $100,000 of assessed value each year for the $720 million bond issue that was passed Tuesday to build labs and school libraries and renovate older schools. Voters in Marysville Joint Union School District in rural Yuba County defeated a bond issue one-tenth the size of Santa Clara’s that would have cost homeowners more: $56 per $100,000 of assessed value to fix roofs and upgrade schools with technology and security measures.

A study that looked at school financing for the research project Getting Down to Facts II documented vast inequalities among communities’ ability to provide safe and adequate school buildings. It described a “regressive” funding system in which districts with the largest proportions of low-income children tend to have the lowest property wealth per student.

Credit: Michael Coleman / CaliforniaCityFinance.Com

The orange line compares the historical rate of passage compared with tentative pass rate on Tuesday of 88 school construction bonds requiring 55 percent voter approval (top blue bar) and the combined 13 parcel taxes and 4 bond proposals needing a two-thirds majority.

Parcel taxes are one of the few sources that school districts can use to supplement their general operating budgets. By law, parcel taxes must be a uniform amount per property owner, regardless of the value of the property, and require a two-thirds voter majority for passage. Parcel taxes have been proposed predominately by school districts in the 9-county Bay Area and Los Angeles. That was also true on Tuesday.

Voters in the San Mateo-Foster City School District narrowly defeated the largest proposed parcel tax, $298 per year for 9 years to improve teacher compensation and expand arts and science and math programs. But 74 percent of Culver City Unified School District voters passed a $189, 7-year, parcel tax to reduce class sizes and support core academic programs, and 81 percent of voters in Peralta Community College District in Alameda County renewed a $48 tax per parcel for 8 more years (see page 17 for the list).

Panelists discussed dual admission as a solution for easing the longstanding challenges in California’s transfer system.

A grassroots campaign recalled two members of the Orange Unified School District in an election that cost more than half a million dollars.

Legislation that would remove one of the last tests teachers are required to take to earn a credential in California passed the Senate Education Committee.

Part-time instructors, many who work for decades off the tenure track and at a lower pay rate, have been called “apprentices to nowhere.”

Comments (3)

Comments Policy

We welcome your comments. All comments are moderated for civility, relevance and other considerations. Click here for EdSource's Comments Policy.

BjJohnson 1 year ago1 year ago

Address how School Bond Money is spent? https://www.fcmat.org/PublicationsReports/lacoe-bassett-usd-ab-139-final-report.pdf

Elaine Peterson 4 years ago4 years ago

Please inform me as to the last passed school bond measure in California, how much, how long was this bond to last, and why measure 13 is now needed … again! Also, won’t this be a slippery slope to eventually do away with the Howard Jarvis measure passed for Proposition 13?

Replies

John Fensterwald 4 years ago4 years ago

Elaine: The last state construction bond for education was Prop. 51 in 2016 with $2 billion for community colleges and $7 billion for K-12 with none for UC and CSU. Money from that bond has been disbursed or applied for, leaving no money for other districts seeking money. This Prop. 13 is a state construction bond and has no relation to the Prop. 13 that Howard Jarvis inspired and that voters passed in 1978. It … Read More

Elaine: The last state construction bond for education was Prop. 51 in 2016 with $2 billion for community colleges and $7 billion for K-12 with none for UC and CSU. Money from that bond has been disbursed or applied for, leaving no money for other districts seeking money. This Prop. 13 is a state construction bond and has no relation to the Prop. 13 that Howard Jarvis inspired and that voters passed in 1978. It will not change the tax protections that it established.

This Prop. 13 would raise the cap on the total amount of local bonds that school and community college districts may issue. The ceiling currently is 1.25 percent of the total assessed property value within elementary and high school districts and 2.5 percent for unified school and community college districts. The new ceiling would be 2 percent of total assessed value for elementary and high school districts and 4 percent of total assessed value for unified and community college districts.