Credit: iStockphoto.com

The parent activists who formed Educate Our State say it’s time for the state to stop robbing Peter to pay Paul. Peter, in their view, being the schools and the theft being billions in property taxes.

The San Francisco-based parent organization is circulating an initiative for the November ballot that it says would sever budget machinations that have contributed to school districts’ and community colleges’ financial distress since the Great Recession and leave them vulnerable when the next economic downturn comes.

The nine-page ballot measure, involving a constitutional amendment and four statutory changes, would delve into the complexities of the “triple flip” of 2004 and other clever financing moves that legislators invented while playing a shell game with shrinking public money. But the result of the initiative, “Protection of Local School Revenues Act of 2014,” would be simple: permanently return about $7 billion in property taxes that school districts would have had this year if then-Gov. Armold Schwarzenegger and the Legislature hadn’t shifted the money to cities and counties to cover, in turn, what the state owed to them. The ballot measure would prevent the state from tampering with school districts’ property taxes in the future. Voters already have given cities and counties that protection; they did that by passing Proposition 1A in 2004.

Schools and community colleges are funded through a combination of local property taxes and state taxes. This year, property taxes contributed 16.7 percent of revenue for K-12 and community colleges; that portion would have doubled, to 33.3 percent, if the state hadn’t redirected more than $7 billion owed to schools, according to calculations by Jennifer Bestor, an Educate Our State parent from Menlo Park with a background in finance, who has been deeply involved with the initiative.

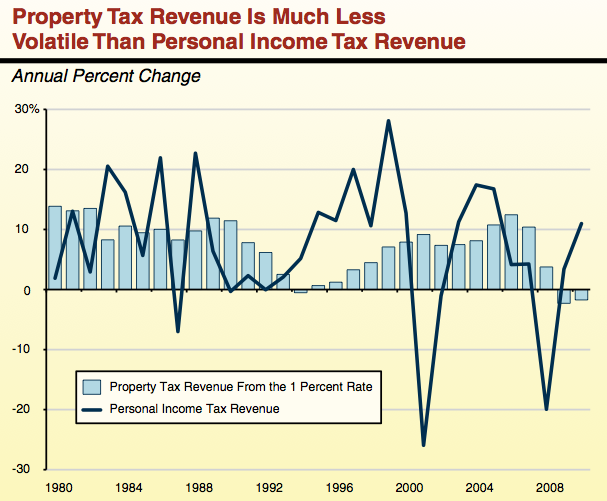

The ballot measure wouldn’t increase money for schools and community colleges; that’s not the intent, Bestor said. Instead, the initiative would swap a volatile source of revenue currently coming to schools – state taxes – for property taxes, a more stable and reliable source that had previously belonged to the schools, she said.

Late payments to school districts illustrate why this is important, Bestor said. After state revenues plunged in 2008, the state responded by postponing payments of money owed to K-12 schools and community colleges to the following fiscal year. Known as deferrals, the late payments grew to nearly $10 billion in 2010-11, nearly a third of the state’s portion of school funding. Those districts that couldn’t borrow money from their county treasurer turned to other lenders and paid higher interest rates; districts in the worst financial shape, which couldn’t borrow, cut programs and jobs.

The districts most adversely affected by deferrals included districts in San Bernardino County and Ravenswood School District in East Palo Alto, which had the least property wealth per student and therefore relied on state revenue for most of their school funding. They also generally have high percentages of low-income children. Increasing districts’ reliance on state revenue to fund schools created more pain for schools, Bestor argues.

Gov. Jerry Brown is the first to acknowledge that deferrals, part of what he calls the state’s “wall of debt,” have harmed schools and community colleges. That’s why he is proposing to expedite ending late payments by paying off the last $6 billion in deferrals in the 2014-15 state budget. And, to deal with the volatility of state revenues, Brown wants the Legislature to create a bigger rainy day fund tied to fluctuations in capital gains revenue. He would add a second tier of protection within the rainy day fund to smooth out spending under Proposition 98, the formula that determines the annual level of school funding.

Bestor takes cold comfort in these measures. As Brown observed in his summary for the 2014-15 budget, since the Second World War, the state has seen an economic recession every five years, on average, and it’s been 4 ½ years since the last one, leaving schools vulnerable once again to manipulations of the Prop. 98 guarantee if revenues fall.

And a rainy day fund doesn’t address the issue at hand: “First, make us whole; give us our stable, reliable stream back, instead of protecting us from the volatile conditions we have been force-fed,” she said.

Stiff opposition from counties, cities

For supporters of the initiative, the cause is just and the need self-evident. But qualifying for the November ballot by relying on parent volunteers to collect 1.3 million signatures at farmers markets and outside school property by mid-April will be challenging. (Signature gatherers can be spotted wearing Dr. Seuss red-and-white striped “Cat in the Hat” stovepipe hats.) And if the initiative does make the ballot, it will face formidable opposition from cities and counties, which already are complaining that Brown and the Legislature have cut social services severely and unloaded public safety responsibilities on them.

For supporters of the initiative, the cause is just and the need self-evident. But qualifying for the November ballot by relying on parent volunteers to collect 1.3 million signatures at farmers markets and outside school property by mid-April will be challenging. (Signature gatherers can be spotted wearing Dr. Seuss red-and-white striped “Cat in the Hat” stovepipe hats.) And if the initiative does make the ballot, it will face formidable opposition from cities and counties, which already are complaining that Brown and the Legislature have cut social services severely and unloaded public safety responsibilities on them.

This chart by the Legislative Analyst’s Office shows that over 30 years, the personal income tax, which drives state revenue, has been three times as volatile as revenue from the 1 percent tax on property. Property tax revenue tends to lag state economic trends by a year or two. Source: Understanding California’s Property Taxes, by the LAO, Nov. 2012.

The initiative would free up $6.8 billion in the General Fund but requires that the state backfill only $4.3 billion that cities and counties would lose in property taxes. That was the initial amount that was transferred to them in 2004. Since then, the revenue, tied to growth in assessed valuation, has grown by $2.5 billion, which the Legislature may or may not cover when the changes take effect.

“The Educate Our State initiative would impose a severe and immediate reduction to county and city property taxes of about $2.5 billion in 2015-16 and growing over time,” Matthew Cate, executive director of the California State Association of Counties, wrote in an email. “This means counties and cities across the state would have to reduce public services that rely on general purpose revenues, which essentially means public safety reductions. It is difficult to contemplate what a reduction of $2.5 billion in public safety services looks like in our communities, particularly when counties have assumed significant new responsibilities for incarcerating, supervising and rehabilitating new offender populations.”

Katherine Welch, a board member of Educate Our State, said that the organization will announce endorsers of the ballot measure on April 1. Meanwhile, it is asking school boards to back a resolution of support and let elected officials know they’re behind it.

John Fensterwald covers education policy. Contact him and follow him on Twitter @jfenster. Sign up here for a no-cost online subscription to EdSource Today for reports from the largest education reporting team in California.

To get more reports like this one, click here to sign up for EdSource’s no-cost daily email on latest developments in education.

Comments (78)

Comments Policy

We welcome your comments. All comments are moderated for civility, relevance and other considerations. Click here for EdSource's Comments Policy.

Don 10 years ago10 years ago

Local Real Property Is Assessed at Acquisition Value and Adjusted Upward Each Year. The process that county assessors use to determine the value of real property was established by Proposition 13. Under this system, when real property is purchased, the county assessor assigns it an assessed value that is equal to its purchase price, or “acquisition value.” Each year thereafter, the property’s assessed value increases by 2 percent or the rate of inflation, whichever is … Read More

Local Real Property Is Assessed at Acquisition Value and Adjusted Upward Each Year. The process that county assessors use to determine the value of real property was established by Proposition 13. Under this system, when real property is purchased, the county assessor assigns it an assessed value that is equal to its purchase price, or “acquisition value.” Each year thereafter, the property’s assessed value increases by 2 percent or the rate of inflation, whichever is lower. This process continues until the property is sold, at which point the county assessor again assigns it an assessed value equal to its most recent purchase price. In other words, a property’s assessed value resets to market value (what a willing buyer would pay for it) when it is sold. (As shown in Figure 2, voters have approved various constitutional amendments that exclude certain property transfers from triggering this reassessment.)

Don 10 years ago10 years ago

Paul @ 7:48, For some reason I couldn't reply below your comment. I wanted to thank you for your comment and make one correction. PEEF is not discretionary. It is part of the city charter. In addition to a parcel tax, the rainy day fund which ran almost dry last year, and two bond measures for facility upgrades, we also have something called the Quality Teacher and Education Act which provides funding to help increase salaries … Read More

Paul @ 7:48,

For some reason I couldn’t reply below your comment. I wanted to thank you for your comment and make one correction. PEEF is not discretionary. It is part of the city charter. In addition to a parcel tax, the rainy day fund which ran almost dry last year, and two bond measures for facility upgrades, we also have something called the Quality Teacher and Education Act which provides funding to help increase salaries at hard-to-staff schools. Floyd doesn’t seem to realize that SF is way better off than most districts, not to say it has solved the education funding problem – far from it.

There’s also the misguided belief among many that excess tax/basic aid district are sapping the system. If all the extra funding they received was put into the general pool statewide, each student would receive a little less than $100.

Floyd’s idea is that we are a rich city and, therefore, we should be able to have better schools. If he had his way we’d be back to the pre-Serrano era where huge disparities existed between districts. And while they do still exist, they are not nearly as extreme as before. With LCFF’s supplemental and concentration grants in particular and categorical funding before them, the funding paradigm has changed so that we no longer think in terms of equity as in equal. Equity is now related to need so many districts receive far more than others depending on demographics. I have to wonder how that plays out from a constitutional perspective. Margaret Weston, Of Public Policy Institute of California has commented on this. When the flexibility legislation was passed SBX 3_4 in 2009, much of the categorical Tier III money became discretionary or, in effect, general purpose. Therefore, like revenue limits, is was subject to Serrano. Now we are distributing dollars by demographic which was basically the same reason why the court found in favor of Serrano because of the advantage higher property value areas (a proxy for demographics) had over low value areas in terms of funding schools.

Replies

Paul 10 years ago10 years ago

Don, I know what you mean about the word "discretionary", but yours is not the meaning I intended, nor the meaning reflected in the city charter (you'll find the word "discretionary" in the charter itself). In this context, "discretionary" means that the city chooses, above and beyond any external legal obligation, to transfer part of its general fund to SFUSD. The city did so long before the PEEF ballot measure formalized the practice and set … Read More

Don, I know what you mean about the word “discretionary”, but yours is not the meaning I intended, nor the meaning reflected in the city charter (you’ll find the word “discretionary” in the charter itself). In this context, “discretionary” means that the city chooses, above and beyond any external legal obligation, to transfer part of its general fund to SFUSD. The city did so long before the PEEF ballot measure formalized the practice and set dollar amounts and percentages. The PEEF ballot measure itself is a city-level legal obligation, not an external one (such as Serrano, Prop. 13, the revenue swap, etc.). The rainy day reserve, and the City’s decision to grant SFUSD access to that, are likewise “discretionary”.

We agree that this practice of transferring city general fund revenue to a school district is very uncommon.

Paul 10 years ago10 years ago

From the City Charter... "SEC. 16.123-9. STATE REDISTRIBUTION OF LOCAL EDUCATION REVENUES. (a) [...] In adopting this measure, the people of San Francisco choose to provide additional City resources to complement, and not supplant, state funding for the San Francisco Unified School District. (b) Consistent with subsection (a), the people of the City and County of San Francisco specifically find that their contributions to and disbursements from … Read More

From the City Charter…

“SEC. 16.123-9. STATE REDISTRIBUTION OF LOCAL EDUCATION REVENUES.

(a) […] In adopting this measure, the people of San Francisco choose to provide additional City resources to complement, and not supplant, state funding for the San Francisco Unified School District.

(b) Consistent with subsection (a), the people of the City and County of San Francisco specifically find that their contributions to and disbursements from the baseline appropriations and the Public Education Enrichment Fund are discretionary expenditures by the City for the direct benefit of the children of San Francisco, their families, and the community at large. In the event that the State attempts, directly or indirectly, to redistribute these expenditures to other jurisdictions or to offset or reduce State funding to the School District because of these expenditures…”

Don 10 years ago10 years ago

Property devaluations don't equate to property tax decreases unless properties are sold. Your district is important to you as it should be, but I was referring to the overall picture. 20% decreases in state's topping off of the revenue limit bucket left many large urban districts with two choices during the Great Recession - 1. reductions in force and large class sizes or massive borrowing, often at high interest rates. And the borrowing itself can … Read More

Property devaluations don’t equate to property tax decreases unless properties are sold. Your district is important to you as it should be, but I was referring to the overall picture. 20% decreases in state’s topping off of the revenue limit bucket left many large urban districts with two choices during the Great Recession – 1. reductions in force and large class sizes or massive borrowing, often at high interest rates. And the borrowing itself can lead to other problems that could risk receivership. In fact the State had to relax rules in this for that reason.

Replies

el 10 years ago10 years ago

Property devaluations can and do end up as property tax decreases without sales, though it's true there's a lot of overhead in requesting them and thus there's some time lag. In the areas where the devaluation was largest, it was because of foreclosures and many distressed sales. We agree on the problem: deferrals are dangerous and destructive. We just don't agree on the solution. I seek a solution that guarantees all funds, not 50% instead of … Read More

Property devaluations can and do end up as property tax decreases without sales, though it’s true there’s a lot of overhead in requesting them and thus there’s some time lag. In the areas where the devaluation was largest, it was because of foreclosures and many distressed sales.

We agree on the problem: deferrals are dangerous and destructive. We just don’t agree on the solution. I seek a solution that guarantees all funds, not 50% instead of 30%, and to all the services that we consider essential. When the county drops the ball on mental health and libraries because their funding is cut, schools have extra stress and expenditures. This seems like a lot of fuss for little net gain to me, though it’s possible I’m still not following the dollars correctly.

el 10 years ago10 years ago

I read this, I've been deep in the weeds of school finance, and I still am not clear on the point. My local district's budget is roughly 1/3 funded by property tax. (This is a rural area; most parcels are farmed and many have not changed hands since 1978.) If that amount increased to say half, the district would still be receiving state funds to top it off that would be essential to the budget. Yes, the … Read More

I read this, I’ve been deep in the weeds of school finance, and I still am not clear on the point.

My local district’s budget is roughly 1/3 funded by property tax. (This is a rural area; most parcels are farmed and many have not changed hands since 1978.) If that amount increased to say half, the district would still be receiving state funds to top it off that would be essential to the budget.

Yes, the deferrals were terrible. We should not do those, not for schools and not to counties either.

Creating more instability for county funding would not benefit me as a citizen, my daughter, my community, nor the school district.

It seems to me that districts in low income areas will continue to get a substantial percentage of their money from the state rather than property taxes, and that changing this formula will do little to change that, nor help much in the kind of serious economic downturn we experienced.

Replies

Don 10 years ago10 years ago

It will help in a downturn, el. If more revenue comes from property tax which, generally speaking, is a more stable stream than sales and income tax that comprise so much of the State’s GF, the district will have less exposure to decreases in state-supported LCFF funding. Many districts had to borrow at high interest rates to cover the deferrals, which most certainly would be reduced if its property tax share is not tampered with.

el 10 years ago10 years ago

My district didn't have to borrow to cover deferrals, which may be why I see this differently. Any time the state is giving deferrals to anyone, that is a BFD and creating chaos. The first deferral was one day to change the fiscal year, and then they kept doing it with longer payback. That practice is destructive no matter who is at the end of the chain. Our schools depend on the county for mental health services, … Read More

My district didn’t have to borrow to cover deferrals, which may be why I see this differently.

Any time the state is giving deferrals to anyone, that is a BFD and creating chaos. The first deferral was one day to change the fiscal year, and then they kept doing it with longer payback. That practice is destructive no matter who is at the end of the chain.

Our schools depend on the county for mental health services, child welfare services, the library system, etc. In addition, because it’s a rural county, the government is one of the larger non-farm employers for long term steady work, and various frivolous county services like parks are among the things that make our area attractive to families. Moving the volatility from the district to the county is not likely to be a net win for the kids in my community. I’d rather we had a solid rainy day fund and less volatility in general. If the state continues to defer the portion it’s paying of school expenses, it will still be a problem.

I believe also that chart shows volatility in property tax statewide. If I recall correctly, there are quite a few communities that had jaw-dropping property devaluation in the 2008 crisis. That property values stayed steady in Palo Alto and Del Mar didn’t help them.

Katherine 10 years ago10 years ago

There is much we can discuss about inequities, etc. but let's fix this first. The initiative raises no new taxes or fees, and increases transparency of school and state funding - basically just providing the same protection that has worked so well for cities and counties since Prop 1A was passed 10 years ago (which managed to protect ALL local services EXCEPT education!). Please, get this on the ballot - that will build … Read More

There is much we can discuss about inequities, etc. but let’s fix this first. The initiative raises no new taxes or fees, and increases transparency of school and state funding – basically just providing the same protection that has worked so well for cities and counties since Prop 1A was passed 10 years ago (which managed to protect ALL local services EXCEPT education!). Please, get this on the ballot – that will build the voice for children in this state, and address a HUGE violation of the public trust whereby most counties report that property taxes allocated to schools are getting there. This is a big enough lift. We cannot fix anything unless we have transparency. Then we can worry about whether districts are funding more or less because voters will have a more accurate sense of the funds that are actually getting to schools.

Regis 10 years ago10 years ago

The math speaks for itself. LAUSD Annual Cost per Student $12,800 a year (give or take a few dollars, but it's close. I'm going to estimate a class size of 25, which by SoCal standards is small (and go on and correct me if I'm wrong). Formula $12,800 Per Student x 25 Students = $320,000. That's puts it over a 1/4 Million Dollars, PER YEAR! For ONE CLASS! Now, pay the teacher $60,000, add $20K in Benefits and … Read More

The math speaks for itself.

LAUSD Annual Cost per Student $12,800 a year (give or take a few dollars, but it’s close.

I’m going to estimate a class size of 25, which by SoCal standards is small (and go on and correct me if I’m wrong).

Formula

$12,800 Per Student x 25 Students = $320,000.

That’s puts it over a 1/4 Million Dollars, PER YEAR! For ONE CLASS! Now, pay the teacher $60,000, add $20K in Benefits and you still have $240,000 left! Where in the heck, does the rest of it go???

A theoretical elementary school, with only one class for each grade, 1st through 6th, would be pulling in nearly $2 MILLION DOLLARS!!! Well, maybe I’m exaggerating a bit, but $1,920,000 is a lot of Taxpayer or Borrowed Money!

Before you join the endless Government initiated demands for more and more and more money, from a dwindling source, some of you oughta look at, what exactly are you getting out of all of this money from heaven or magic money???

The graduation rate is dismal, our International Ranking sucks, our kids our graduating (if they graduate) with little real knowledge and I think the whole thing oughta be taken down and rebuilt from scratch. Nope, to me, the whole thing is on shaky legs and throwing more money at it is going to do little to nothing, because we’re already throwing huge amounts of money at it right now! Sad, sad, sad. Especially for the taxpayer, who’s going to pony up, more money, for sucky results and hear the crying from the ed community, for ever more money. But wait, ‘It’s for the Children!’.

Wonder where that $240,000 went off too?

Replies

navigio 10 years ago10 years ago

Actually, 25 is not low. Thats the average in LAUSD (about 23 for county and state). So your estimates are too high to start out with. Then there is the problem that not all kids attend school every day. In LAUSD the average ADA seems to be about 83% of enrollment, and since the district doesnt get paid by enrollment rather by ADA, your numbers are too high again. Then average LAUSD ada spending is only about … Read More

Actually, 25 is not low. Thats the average in LAUSD (about 23 for county and state). So your estimates are too high to start out with.

Then there is the problem that not all kids attend school every day. In LAUSD the average ADA seems to be about 83% of enrollment, and since the district doesnt get paid by enrollment rather by ADA, your numbers are too high again.

Then average LAUSD ada spending is only about $10k (11-12 is latest on ed-data, may differ in more recent years), thats again an almost 20% difference.

Then you make a big error in assuming that funding is distributed equally. The ‘average ADA’ is just that, ‘average’. This does not mean that every single student in the district is funded at the same level. In our own district, there are some schools that are funded well over $25k per student, with many others being funded well below the average in order to achieve that average. Even within a school, the teacher to student ratio is highly variable. Standard classes are generally between 30 and 40 in elementary. How is that possible you might ask given the average of 25? Well, its weird how averages work. There are some classes that only have a few students per teacher. That makes a huge difference when calculating the average (one real problem with ever using average class size for anything useful).

Then there is the sticky issue of how the funding is actually used. Many of the smallest classes are special education classes and those are funded at least partly from money that cannot used for anything else. While it is true it contributes to the ‘averages’ calculations, the fact that per pupil spending is so much higher for special education distorts the overall district average number you are using. Add onto that, that there is probably a 10% to 15% general fund encroachment to special education and you even have to reduce the funding for what you might consider a standard classroom.

Your average pay is a bit low, again maybe 15%.

And your point about graduation rate is also relevant. That impacts ADA disproportionately by grade.

Anyway, your claim that ‘its for the children’ is a lie implies that you think the money is going somewhere else? Where do you think its going? And more importantly, how much of it is going there? Are you saying we should actually be cutting school funding right now? In fact, taking your calculations at face value, your implication is that we are spending 75% of our funding on something things outside of the school and classroom. This means total LAUSD revenue should be $2500/student instead of the $10k it currently is, and the budget for the nearly 650 thousand kids should be reduced from the nearly $6B it currently is to about $2.5B give or take a few hundred millions. Right?

Manuel 10 years ago10 years ago

navigio, a few corrections: 1) that 650 thousand enrollment you got there is wrong because it includes the students enrolled in the charter schools that LAUSD charters. Stupid, I know, but that's how DataQuest treats the numbers. Second, funding for a given year is based not on that year's enrollment, but on the previous one. Yes, you read that right: the enrollment on "census day" on October 2013 defines the base level for 2014-15. The ADA … Read More

navigio, a few corrections:

1) that 650 thousand enrollment you got there is wrong because it includes the students enrolled in the charter schools that LAUSD charters. Stupid, I know, but that’s how DataQuest treats the numbers. Second, funding for a given year is based not on that year’s enrollment, but on the previous one. Yes, you read that right: the enrollment on “census day” on October 2013 defines the base level for 2014-15. The ADA is also calculated from the previous year.

2) the number of students per teacher is another wacky number: it is obtained by dividing the enrollment over the total number of certificated personnel. But, as you point out, the number of students in a classroom varies. For instance, Special Ed classrooms have, on average, half the number of students that regular classrooms have. In addition, all those low level administrators at schools do not have administrative credentials, but teaching credentials. And they are counted as teachers when the numbers get reported to the state. So there goes your student-to-teacher ratio. For the record, LAUSD classrooms are “normed” at different densities: K-3: 24 students (29.5 if not in the Class Size Reduction Program);4-5: 30.5 if PLBAO or 39 if not; 6-8 is “34.00 in four (4) academic periods and 42.50 in two (2) non-academic periods with a maximum average class size of 36.43,” and 9-12 are simpler: “42.5:1 to 34.0:1,” Of course, with these averages, some classes will be really packed. It goes without saying that the numbers are all over the place.

3) I doubt that the average salary is a high of $60k given that this level can be achieved if you are at the top step with 23 salary points. That takes a minimum of 10 years on the job and only a third of the teachers at LAUSD has that seniority (one third has 5 to 10 years and the rest are rookies; all this according to the NCTQ’s “study” of LAUSD), so there goes the teacher cost.

4) Special Ed costs not funded by the feds/state is nearly 50% if one believes the numbers reported by LAUSD (and if my memory is correct as I don’t want to fact-check this right now), and, finally,

5) LAUSD spends considerable funds outside of the “regular” classroom. The latest figures I have (from the 2013-14 approved budget) for teacher positions is $1,928.4 million (including benefits), out of $2,855.5 million spent at school sites. (This yields $5,365/kid once ADA is included.) This is to be compared to “off school site” expenses of $2,227.9 million and $1,375.4 million budgeted for special ed costs.

If the entire General Fund for 2013-14 ($6,458.8 million) is divided by the expected ADA (532,201.69) then that yields $12,136/student. This is, of course, deceiving since the “off-site costs” are nearly the same as the “school site costs.”

It is worth noting that LAUSD expected to have 75,310 special ed students in 2013-14. If the budgeted Sp Ed costs are divided over this number, then the cost for each Sp Ed student is $20,621.43. Compare that to $5,365.45 calculated for “on-site” costs per student.

It can be argued that many of the “off-site” costs are necessary to run the District. But this is not simple to sustain once the line items are scrutinized.

Carry on…

Jennifer Bestor 10 years ago10 years ago

Excuse me, “before you joint the endless Government initiated demands for more … money”?

Uh, did you read any of this? The initiative simply demands that the property tax already allocated to schools goes to schools. There are NO new taxes and NO new fees involved in this initiative. It simply stops a shell game that allows the government to siphon money intended for schools off to other uses.

Manuel 10 years ago10 years ago

IMO, while it makes sense to keep the county funds locally, as Mr. Premack observes, it does not increase funds to schools. It might not even guarantee the level of funding since the funds "captured" by this proposition are no better than those of Prop 30: a "guarantee" is made that schools will receive a minimum level of funding, but never an increase since the state can always reduce the "backfill" by deferring funds. No … Read More

IMO, while it makes sense to keep the county funds locally, as Mr. Premack observes, it does not increase funds to schools. It might not even guarantee the level of funding since the funds “captured” by this proposition are no better than those of Prop 30: a “guarantee” is made that schools will receive a minimum level of funding, but never an increase since the state can always reduce the “backfill” by deferring funds. No different than what’s happened recently.

But I agree that it would stop this shell game. All it does it keeps accountants at certain agencies employed. Is that worth the churn?

Replies

Jennifer Bestor 10 years ago10 years ago

As parents deeply concerned about public school funding in California, we think it is worth stopping the shell game. As long as the state can use educational funding streams to pay its own unrelated debts — invisibly — there will be endless high-profile ‘spending’ on education … while California schoolchildren remain at the bottom of the national heap.

As you say, keeping accountants at certain agencies fully employed is hardly worth the churn.

Eric Premack 10 years ago10 years ago

Upon further review (this one is very complex), I believe the following is correct: 1) The measure is unlikely to bring additional revenue to most school districts because the state captures the benefit of additional local property tax funding by simply reducing the district's entitlement to state aid--in most cases this reduction is dollar-for-dollar. This was true under the "old" Revenue Limit system and will continue under the new LCFF. The result is no … Read More

Upon further review (this one is very complex), I believe the following is correct:

1) The measure is unlikely to bring additional revenue to most school districts because the state captures the benefit of additional local property tax funding by simply reducing the district’s entitlement to state aid–in most cases this reduction is dollar-for-dollar. This was true under the “old” Revenue Limit system and will continue under the new LCFF. The result is no additional funding for most school districts.

2) The only scenario where schools districts generally would get more funding is if the increased property taxes trigger an increase in funding under the state’s “Prop 98” minimum education funding guarantee. Presumably this would only occur under certain years, depending on the details of the Prop 98 formulas. In recent years, however, the state has proven very adept at manipulating the Prop 98 formulas to benefit the state’s budget, not school districts’.

3) The school districts that are the exception to the above and would consistently benefit are property-rich “Basic Aid” districts. This measure would prohibit the state from ever touching these districts’ largesse–either directly or indirectly. This might even include precluding the state from implementing the recent “fair share” categorical funding reductions that were levied against some Basic Aid districts in the state’s attempt to ensure that rich districts experienced at least some of budget pain experienced by other less affluent districts.

Replies

Jennifer Bestor 10 years ago10 years ago

Eric, thanks so much for engaging on this. It is extraordinarily complex. As I explained in another post, this initiative will not affect Basic Aid districts at all. If you read the initiative, it does not and could not preclude reallocation of property taxes among educational entities within a county (basic aid and non-basic aid). (It could not because otherwise we would have had to define ERAF's role, which changes as … Read More

Eric, thanks so much for engaging on this. It is extraordinarily complex. As I explained in another post, this initiative will not affect Basic Aid districts at all. If you read the initiative, it does not and could not preclude reallocation of property taxes among educational entities within a county (basic aid and non-basic aid). (It could not because otherwise we would have had to define ERAF’s role, which changes as districts pop in and out of basic-aid status and as funding needs shift between elementary, secondary and community college districts). What it does is to keep property tax allocated to education within educational entities in a county. Period.

Yes, re. #1, it is unlikely to bring additional revenue into districts (especially given what you correctly note about Proposition 98’s malleability in the hands of the State). HOWEVER, it should stabilize the arrival of those revenues.

Remember that, in early 2008, the VLF Swap had already handed out $2.7 BILLION more school property tax above the backfill obligation. And by late 2008, the schools were handed about a $3 billion deferral. Sacramento then went silent for three years about the situation until Gov. Brown was elected, whereupon the excess handout had grown to $1.4 billion a YEAR in 2011-12 — and deferrals climbed another $2 billion. The bottom line was that stable, reliable property tax had been taken away from schools — indeed, in sizable excess of any underlying obligation — making them dependent upon the fluctuating fortunes of the state’s general fund. We simply want the reliable funding going IN the schools. And not tiptoeing invisibly out the backdoor in no relation to any obligation.

One can say that, yes, schools are being repaid now. True. But you can’t repay the schoolchildren who’ve seen five years of their educations disrupted by ever larger class sizes, fewer instructional days, and administrations struggling with cash flow management.

And, finally, #2 was a complete surprise to us. Since the state doesn’t actually publish any of its Proposition 98 calculations, who knew there was a Test 3B that would punish schools for property tax shortfalls (viz the excesses being paid out under the VLF Swap) or land them with a windfall if this Initiative should take effect in a Test 3B year? Amazing. And, incidentally, the “guarantee” under which $7B+ of bedrock funding has been removed from non-basic-aid districts for the past ten years.

Don 10 years ago10 years ago

Jennifer, While your knowledge is extensive, I think it would behoove you to present your case in a fashion that is more easily understandable, especially since this is a ballot initiative. As I understand it, since this initiative is revenue neutral, it isn't about recovering lost funding, but ensuring that new funding comes from the more reliable property tax stream. Please correct me is I'm wrong. To pay off the Economic Recovery Bonds of 2004 and because the … Read More

Jennifer,

While your knowledge is extensive, I think it would behoove you to present your case in a fashion that is more easily understandable, especially since this is a ballot initiative.

As I understand it, since this initiative is revenue neutral, it isn’t about recovering lost funding, but ensuring that new funding comes from the more reliable property tax stream.

Please correct me is I’m wrong. To pay off the Economic Recovery Bonds of 2004 and because the local governments are statutorily protected from state seizure of local property taxes, California increased its portion of the then $7.25% sales and use tax by.25% and decreased the local portion by the same. To make up for the loss to cities and counties they took it from the schools’ portion of property tax and in turn told the schools they would be reimbursed by the state – thus completing the triple flip. So when the economy goes sour the State decreases it revenue limit funding accordingly or defers it in essence. Had the school districts been getting their fair share of property tax they wouldn’t get hit so hard by the loss of state funding since that revenue stream is likely to have more stability. And as Katherine explained so clearly in the beginning, all this is on the backs of kids because they didn’t have any advocates when the triple flip was dreamed up.

At least now they do.

Replies

Jennifer Bestor 10 years ago10 years ago

Thank you, Don. I’m a decent parent, an incredible analyst, and a lousy pundit. (That’s why it’s taking 50,000 of us to get this fixed.) Thanks for putting your shoulder to the wheel.

Don 10 years ago10 years ago

This is semantics in one sense. When the State created revenue limits, it determined how much a district would receive whether it was locally generated or not (basic aid withstanding). From the standpoint of the school it didn’t matter whether it generated from local property taxes, sales taxes , the States general fund or some other revenue stream.

Floyd Thursby 10 years ago10 years ago

Jennifer, this makes a lot of sense. I've always known there was something rotten in Denmark as relates to this practice and always felt San Francisco really could, if they chose, put more into their schools from the general fund. Is this true? Also, you analyze San Mateo as one of the most maligned districts due to this. What is your analysis of San Francisco as pertains to this? I would imagine … Read More

Jennifer, this makes a lot of sense. I’ve always known there was something rotten in Denmark as relates to this practice and always felt San Francisco really could, if they chose, put more into their schools from the general fund. Is this true?

Also, you analyze San Mateo as one of the most maligned districts due to this. What is your analysis of San Francisco as pertains to this? I would imagine we are hurt a lot as we have fewer kids and lots of taxes, so I never understood why we couldn’t be a basic aid district, but no one in SF seems to want to become one.

It leads to odd discrepancies like SF paying teachers 48.4% of what police earn and San Diego 73.3%.

Can you explain this?

Eric Premack 10 years ago10 years ago

Is this proposed measure really simply a way to protect property-rich “Basic Aid” school districts where local property tax revenues exceed the amounts districts would otherwise receive from the usual state funding formulas?

My preliminary read is that the primary impact is to allow these heavily-funded districts to retain all of the local property tax funds and to prevent the state from compelling them to share these extra funds.

Replies

Jennifer Bestor 10 years ago10 years ago

Quite the opposite, Eric. Basic-aid districts have always been able to retain all their property tax. It's the revenue-limit districts that -- the minute they take the "governor's nickel" -- are liable to have all their property tax taken. Thus, in San Mateo County, every penny of property tax is removed from Ravenswood, Redwood City Elementary, Pacifica, etc., while Woodside, Menlo Park, Portola Valley, Las Lomitas, etc. remain untouched. But don't trust me! … Read More

Quite the opposite, Eric. Basic-aid districts have always been able to retain all their property tax. It’s the revenue-limit districts that — the minute they take the “governor’s nickel” — are liable to have all their property tax taken. Thus, in San Mateo County, every penny of property tax is removed from Ravenswood, Redwood City Elementary, Pacifica, etc., while Woodside, Menlo Park, Portola Valley, Las Lomitas, etc. remain untouched.

But don’t trust me! Go to Ed-data.k12.ca.us and look up these districts. Notice how there’s a negative number under “ERAF/Educational Revenue Augmentation Fund” that zeroes out secured and unsecured property tax? That’s the VLF Swap/Triple Flip in action.

The great thing about San Mateo County is that it is crystal clear how the system works against disadvantaged districts. In other counties, it’s masked by the way the money is taken from ERAF first. However, Kings and Imperial are low-property-wealth counties that show the deep hand of the state in every district’s pocket (again, check out negative ERAF), while in Marin and Napa you’ll see the state’s hand in revenue-limit districts, while basic aids are untouched.

Gary Ravani 10 years ago10 years ago

Revenue limit has now been modified by LCFF. Basic Aid districts get funded due to the original "hold harmless" provisions of RLI. RLI was a (quasi) effort to "equalize" funding across districts to deal with the unconstitutional funding of schools based on the revenue generated by local property taxes. This finding based on Serrano v. Priest. Are you suggesting this initiative would undo the findings of Serrano? So local schools would return to being funded by revenue … Read More

Revenue limit has now been modified by LCFF. Basic Aid districts get funded due to the original “hold harmless” provisions of RLI.

RLI was a (quasi) effort to “equalize” funding across districts to deal with the unconstitutional funding of schools based on the revenue generated by local property taxes. This finding based on Serrano v. Priest.

Are you suggesting this initiative would undo the findings of Serrano? So local schools would return to being funded by revenue from property taxes generated only in their own counties?

Jennifer Bestor 10 years ago10 years ago

Gary, this initiative would respect the spirit of Serrano, rather than perverting it. The spirit was that local levels of property tax should not determine the quality/funding of the education that local schoolchildren received. The perversion has been the false extension that, therefore, property tax is bad for schools. The cleanest analogy is mashed potatoes and gravy. Imagine a large (state-shaped) platter of mashed potatoes, all peaky in parts. The peaks are … Read More

Gary, this initiative would respect the spirit of Serrano, rather than perverting it. The spirit was that local levels of property tax should not determine the quality/funding of the education that local schoolchildren received. The perversion has been the false extension that, therefore, property tax is bad for schools.

The cleanest analogy is mashed potatoes and gravy. Imagine a large (state-shaped) platter of mashed potatoes, all peaky in parts. The peaks are basic-aid districts – poking up above the valleys and providing a relatively adequate per-student spend. The valleys are revenue-limit districts — below their per-student target. State Aid has been gravy, poured to bring the valleys up to a standard amount (usually in the $5-6K range) per student.

The VLF Swap and Triple Flip drilled holes in the bottom of the platter and sucked out mashed potatoes from the bottom of the revenue-limit areas — and only the revenue-limit areas — with the promise that more State Aid gravy would be poured in and make everything equal and fair. However, the state ran out of gravy in 2007-08, and 08-09, and 09-10, and 10-11, and 11-12 …

The Initiative simply says, LEAVE THE MASHED POTATOES ALONE! They are the bedrock funding of all school districts. The net effect is that less gravy is needed, meaning the state has it to pour into paying its own debts, rather than making the (revenue limit) schools do it.

Does that help? I’m afraid we’re pretty good parents, and decent economists, but weak pundits! The initiative simply seeks to leave the most reliable, stable form of tax revenue IN THE SCHOOLS rather than letting the state extract it to pay its own debts, leaving the schools even more reliant on the whims of the stock market (= state income taxes).

Gary Ravani 10 years ago10 years ago

Jennifer: I am still not clear on the intent of the initiative. Serrano asserted that school funding based on local property taxes was inherently inequitable because there are (continuing) huge disparities in the value of property depending on locality. If all state property taxes are collected and then dispersed with schools getting their proportion and based on LCFF then you have the potential for equity. If this is a return to keeping property taxes collected within … Read More

Jennifer:

I am still not clear on the intent of the initiative. Serrano asserted that school funding based on local property taxes was inherently inequitable because there are (continuing) huge disparities in the value of property depending on locality. If all state property taxes are collected and then dispersed with schools getting their proportion and based on LCFF then you have the potential for equity. If this is a return to keeping property taxes collected within the county in which they are assessed then you would seem to have a violation of “the spirit of Serrano.” Please explain.

Thanks.

Jennifer Bestor 10 years ago10 years ago

Gary, State property taxes are NOT and never have been collected or disbursed by the state. Constitutionally, they must remain within the county in which they were levied. The state's power has only been (and only since Proposition 13, incidentally) to direct the allocation of those property taxes among entities within that county. Proposition 1A in 2004 stopped the state's ability to do so with respect to every local entity -- except schools! … Read More

Gary, State property taxes are NOT and never have been collected or disbursed by the state. Constitutionally, they must remain within the county in which they were levied.

The state’s power has only been (and only since Proposition 13, incidentally) to direct the allocation of those property taxes among entities within that county. Proposition 1A in 2004 stopped the state’s ability to do so with respect to every local entity — except schools! So now the state cannot redirect property taxes allocated to cities, or counties, or lighting districts, or even our hospital district (the hospital was sold years ago, but still collects property tax!) — just schools’ property taxes. Which it has directed away from schools.

And, interestingly, Gray Davis tried to take property taxes away from basic-aid school districts in 2002 and was slapped down politically (oddly, a great number of donors to liberal causes seem to live in basic-aid districts!). Which is part of the reason that basic-aid districts do not suffer from the VLF Swap/Triple Flip — while our less wealthy neighbors carry the burden.

Jennifer Bestor 10 years ago10 years ago

In addition, the Initiative actually compels the state to take its hand out of the shared funds -- returning them to the property-poor school districts. The reason this diversion remained out of sight for so long is that the first funds taken are, in fact, the shared extra (ERAF) funds. Rev & Tax Code sections 97.68 and 97.70 directs that the shared county-wide fund (which basic-aid taxpayers pay into but cannot draw out of) be … Read More

In addition, the Initiative actually compels the state to take its hand out of the shared funds — returning them to the property-poor school districts.

The reason this diversion remained out of sight for so long is that the first funds taken are, in fact, the shared extra (ERAF) funds. Rev & Tax Code sections 97.68 and 97.70 directs that the shared county-wide fund (which basic-aid taxpayers pay into but cannot draw out of) be diverted first. When that is emptied (as it is in half the counties), then the base property taxes of *non-Basic Aid* districts are available for the taking.

So, hard as it is to believe, the Initiative gives some of the ‘good, reliable, stable green stuff’ BACK to poor districts. (I know, it’s hard to believe that parents would go to war for mere fiscal sanity. But as long as the state, cities and counties figure out ways to extract revenue from schools, we will always compete with Mississippi and Utah to see how little we can spend on schoolchildren.)

Don 10 years ago10 years ago

You are misreading the headline. They aren’t talking about giving property taxes back as in returning to the pre-Serrano era. They are saying that the $7B lost would be returned to the schools as part of the new funding formula. Did you not read the article?

So you are still sticking with the “Upstairs, Downstairs” education finance agenda? You honestly want school district funding to be based upon how much each district can scrape together?

.

Floyd Thursby 10 years ago10 years ago

The new system is pretty much based on the Serrano decision with some new twists. It is not, as the headline suggests, truly giving the property taxes back to the counties and letting them decide how to spend it. San Francisco may benefit a little due to higher ESL students and poverty, but not as much as it could by having a lower percentage of children and a high tax base due to … Read More

The new system is pretty much based on the Serrano decision with some new twists. It is not, as the headline suggests, truly giving the property taxes back to the counties and letting them decide how to spend it. San Francisco may benefit a little due to higher ESL students and poverty, but not as much as it could by having a lower percentage of children and a high tax base due to tourism, real estate speculation and downtown. It’s a new system, but Serrano is a controlling uncle and has not left the room.

Replies

Jennifer Bestor 10 years ago10 years ago

Floyd, The current reality is antithetical to the Serrano decision. Hard as it is to believe, the VLF Swap has taken property tax AWAY from the poorest districts -- not the richer ones. The VLF Swap has done so by draining, first, the county Educational Revenue Augmentation Funds -- the pooled county-wide property tax that (since 1992) had been used to back fill districts proportional to their need. In San Francisco (a coterminous … Read More

Floyd, The current reality is antithetical to the Serrano decision. Hard as it is to believe, the VLF Swap has taken property tax AWAY from the poorest districts — not the richer ones.

The VLF Swap has done so by draining, first, the county Educational Revenue Augmentation Funds — the pooled county-wide property tax that (since 1992) had been used to back fill districts proportional to their need. In San Francisco (a coterminous city/county/school district), ERAF has been an odd (rather unproductive) concept. But, just south of you in San Mateo County, it contains about 14% of total property tax from across the county (including property owners in basic-aid districts), and redistributed it only to revenue-limit districts until 2004. In this way, the wealthier areas subsidized education for poorer areas with stable, reliable, growing property tax.

But the ERAF fund in each county is now drained first to satisfy the state’s debts — the Triple Flip and VLF Swap. So poorer school districts are thrown back on their original (low) property tax funding — plus whatever state aid actually arrives (net of deferrals).

And in those counties where the ERAF fund proves insufficient (about half of them), county controllers then take the base property tax proportionately out of each revenue-limit school district.

– In San Mateo (due to the odd fact that 60%+ of the students are in basic-aid districts), this means taking ALL the property tax from every revenue-limit district. Napa and Marin have also experienced the situation where revenue-limit districts have had significant redirections of base property taxes, since their neighbor basic-aid districts were exempt.

– In medium property wealth counties where ERAF was insufficient, it has generally meant a little haircut of base property taxes. (Ventura, Yolo, Monterey, Orange, for example.)

– In low property-wealth counties like Imperial, Fresno and Tulare, it means taking a giant chunk of base property tax from every school district.

Your error is understandable. Throughout the educational community, the words “Property Tax” seem to evoke a knee-jerk negative reaction that goes a long way to explaining how the Legislature could take one of the most reliable, stable, growing revenue streams away from schools — with nary a peep of protest. (Except, interestingly, Carole Migden from the Board of Equalization … which oversees … property tax!)

Don 10 years ago10 years ago

I don't know if you heard, Floyd, (I kind of doubt it), but the era of revenue limits is over and California has a new funding formula where districts with large underperforming and immigrant groups like SFUSD will get much more than in the past. It's brand new world in education finance. When you say "this is true..." unless I'm mistaken, you seem to be commending - yourself? Read More

I don’t know if you heard, Floyd, (I kind of doubt it), but the era of revenue limits is over and California has a new funding formula where districts with large underperforming and immigrant groups like SFUSD will get much more than in the past. It’s brand new world in education finance.

When you say “this is true…” unless I’m mistaken, you seem to be commending – yourself?

Floyd Thursby 10 years ago10 years ago

This is true, but it doesn’t mean there couldn’t be a factor for cost of living, as there is with DMV workers. Also, it’s not set in stone. Many states still have districts right next to each other with one having double the funding or more because it is wealthier. It violated the California Constitution, which is far easier to change than the federal one.

Floyd Thursby 10 years ago10 years ago

I meant while teachers in Manteca, far cheaper, earn more.

Floyd Thursby 10 years ago10 years ago

I believe that there should at minimum be an adjustment for cost of living Don. Why should police earn nearly double what they earn in Manteca while police in Manteca earn more? Why should DMV workers, firemen, private school teachers, plumbers, almost everyone earn nearly double with the sole exception of police? No one has ever explained to me why this is fair. I understand a rich suburb right next to … Read More

I believe that there should at minimum be an adjustment for cost of living Don. Why should police earn nearly double what they earn in Manteca while police in Manteca earn more? Why should DMV workers, firemen, private school teachers, plumbers, almost everyone earn nearly double with the sole exception of police? No one has ever explained to me why this is fair. I understand a rich suburb right next to a poor suburb or inner city, I get that. But what I don’t get is why every line of work except teaching should be allowed to pay more to attract good people. Only teaching should be subject to a formula which does not take cost of living into account. We get more tax revenues because we are a city with a higher cost of living, but then we can’t pass those on in that way ONLY FOR EDUCATION. We can pass it on for police, fire, DMV, Supervisor’s Aides, government doctors, and everyone else. We can’t for teachers. That isn’t fair to children or teachers. We get more taxes at least partially because our real estate is high, but it’s distributed based on the old real estate prices which were equal across the state in 1970. How is this sensible? I’ve never understood this. I suspect you feel this way because you don’t want teachers in SF to ever get a raise, so any means which could lead to it is something to find reasons to oppose.

Floyd Thursby 10 years ago10 years ago

I thought I posted this before, there's a problem with this site, please fix it, sometimes it says you posted then it's not there. San Francisco pays police far more than police in San Diego, nearly double, yet teachers in SF actually earn less despite higher cost of living. Teachers in SF earn 48.3% of police salaries, and in San Diego the figure is 73.3%. We can't have an equal quality school system if … Read More

I thought I posted this before, there’s a problem with this site, please fix it, sometimes it says you posted then it’s not there.

San Francisco pays police far more than police in San Diego, nearly double, yet teachers in SF actually earn less despite higher cost of living. Teachers in SF earn 48.3% of police salaries, and in San Diego the figure is 73.3%. We can’t have an equal quality school system if teachers are underpaid commensurate with private schools, DMV workers, police and every other profession which is paid more because San Francisco costs more and therefore gets more taxes.

We are suffering due to this Serrano case unduly. At that time there was less of a cost of living difference than there is now. Children here suffer due to this. Also, because so many go private, move after their kids get older, and have fewer kids, we should have more dollars per child. San Francisco is putting over $2 in for every $1 it gets back. Allowing property taxes to determine it could give us over 20,000 per pupil rather than under 10,000 now.

There should at least be an adjustment for cost of living. I was hoping this would be a vote on a reversal of the Serrano decision, not just something Arnold did in 2004 which has little impact. Reversing Serrano would be great for San Francisco.

Lesli Kraut 10 years ago10 years ago

This initiative is ONLY about transparency and stability. The inequites of School Districts being funded with local property taxes was changed decades ago. All we are asking is that the portion of local property tax that is designated to fund schools go to schools in the same year it is collected. Why is it ok to force our School Districts to find alternate funding sources for money that should have been paid to … Read More

This initiative is ONLY about transparency and stability. The inequites of School Districts being funded with local property taxes was changed decades ago. All we are asking is that the portion of local property tax that is designated to fund schools go to schools in the same year it is collected. Why is it ok to force our School Districts to find alternate funding sources for money that should have been paid to them in the first place? Parents have been sitting on the dielines for too long. It’s time we spoke out for transparency and stable funding for all our schools and our children.

Don 10 years ago10 years ago

Let's say, Floyd, you live with your family in a rich retirement town or on oil-rich land. There's lots of property tax revenue and few kids, therefore, according to your logic (if one wants to call it logic), your kids should get the royal treatment for public education! Conversely, according to your same logic, if you live in a community with lots of kids they should suffer a loss of educational opportunity. That … Read More

Let’s say, Floyd, you live with your family in a rich retirement town or on oil-rich land. There’s lots of property tax revenue and few kids, therefore, according to your logic (if one wants to call it logic), your kids should get the royal treatment for public education! Conversely, according to your same logic, if you live in a community with lots of kids they should suffer a loss of educational opportunity. That evil Serrano case! how dare they try to distribute tax revenue equally!

Moral of story, if you have a family live in an area with the fewest possible kids.

Oh Floyd, how far your liberal values have sunk.

Are you for real?

Floyd Thursby 10 years ago10 years ago

Don, it is very unfair to San Francisco. We always hear if people go to private school, that leaves more money for the kids in public school. No, in SF nearly 30% go private and many others move. We have a low % of kids in public school, only 55,000 out of 820,000, far lower than most places, so we should have more money per pupil. we should have 20,000 plus. … Read More

Don, it is very unfair to San Francisco. We always hear if people go to private school, that leaves more money for the kids in public school. No, in SF nearly 30% go private and many others move. We have a low % of kids in public school, only 55,000 out of 820,000, far lower than most places, so we should have more money per pupil. we should have 20,000 plus. We put it into this pot, and we lose most of it to suburbs. We have very integrated schools. We pay everyone else more due to cost of living. Our police earn 121,000, and teachers, 58,800. Teachers also don’t get health coverage. DMV workers make more here, everyone does, except teachers.

We need money for Kumon, tutoring, and other programs. We have many poor and immigrant children.

The fact that we have fewer kids in public school should fairly translate to more money per child. If we get our property taxes back, then that would benefit us. The Serrano lawsuit was horrible for San Francisco. We should at least get more money due to cost of living. That’s just wrong. We should be allowed to put general fund taxes into our schools. Our children are suffering!

Don 10 years ago10 years ago

Did you read the article upon which you're commenting? Your comments have nothing to do with it. Paul hit the nail on the head when he said - Fundamentally, it’s time to stop pretending that property tax is a local source of revenue. Property taxes revenue, in the main, goes into the State's GF and redistributed from there to the districts for a good reason - the opposite was inequitable and unconstitutional. Before, when a wealthy … Read More

Did you read the article upon which you’re commenting? Your comments have nothing to do with it.

Paul hit the nail on the head when he said – Fundamentally, it’s time to stop pretending that property tax is a local source of revenue.

Property taxes revenue, in the main, goes into the State’s GF and redistributed from there to the districts for a good reason – the opposite was inequitable and unconstitutional. Before, when a wealthy and a poor district wanted to raise property taxes to fund schools, the wealthy district could raise the same amount of money with far less of a tax increase. So poor districts had to pay more for the same appropriation. That had to stop because it deprived children of equal educational opportunity when some districts couldn’t afford to fund their children as well as others.

Replies

Jennifer Bestor 10 years ago10 years ago

Well, no, Don. This is the myth that cities and counties have fed citizens, allowing those cities and counties to squirrel away the most stable, reliable, local funding stream for themselves. First, per the California Constitution, not a penny of property tax can leave the county in which it is paid. This is why, in making schools fund the Economic Recovery Bonds of 2004, the mechanism was for cities/counties to transfer sales taxes to … Read More

Well, no, Don. This is the myth that cities and counties have fed citizens, allowing those cities and counties to squirrel away the most stable, reliable, local funding stream for themselves.

First, per the California Constitution, not a penny of property tax can leave the county in which it is paid. This is why, in making schools fund the Economic Recovery Bonds of 2004, the mechanism was for cities/counties to transfer sales taxes to the state, then schools to ‘compensate’ those cities/counties with educational property tax. The state could not force schools to transfer money to the state General Fund. But it could force them to pay other local entities within their counties.

Second, the Serrano situation has formed a lovely smokescreen to pretend that the forced transfers of property taxes were ‘fair and equitable,’ while they’ve been anything but. If you’ll go to the EducateOurState initiative website and drill down on different counties, you’ll see that the school districts that have suffered most have been those with the least property tax, hence were already highly reliant on State Aid. Go look at Kings and Imperial Counties, for example, where over a third of ALL property tax was taken to fund the VLF Swap and Triple Flip — and the payback was in deferrals. Look at San Mateo, where basic-aid districts lost nothing — and revenue limit districts lost every penny of property tax, and were left with … deferrals. By saying, “take this property tax cup from my lips,” education has disdained wine in favor of egalitarian bilge water. And hurt the poorest children most.

Third, the ability of the state to force local entities to compensate one another (cities to schools, schools to counties, etc.) was what led to Proposition 1A being passed in 2004, which stopped the state’s ability to redirect or reallocate property tax allocated to cities, counties, sewer district, flood districts, mosquito control districts, lighting districts, etc., etc. — leaving only school property taxes unprotected. Hence, within the long greedy arm of Sacramento.

navigio 10 years ago10 years ago

To me, this post by Jennifer more plainly illustrates the issue than any other text or presentation I’ve seen to date.

Floyd Thursby 10 years ago10 years ago

Jennifer/Katherine, can you answer my questions above as to what is possible? Do a few cities spend more than SF?

Floyd Thursby 10 years ago10 years ago

Would this allow each district to fund it on property taxes rather than have their taxes put into a general pot and redistrubuted due to the lawsuit in the early '70s and Prop 13? That would be great for San Francisco. We pay teachers 48.3% of what we pay police while San Diego pays 73.3%, due to the Serrano lawsuit, and we have fewer kids in public school as a percent, a rich … Read More

Would this allow each district to fund it on property taxes rather than have their taxes put into a general pot and redistrubuted due to the lawsuit in the early ’70s and Prop 13? That would be great for San Francisco. We pay teachers 48.3% of what we pay police while San Diego pays 73.3%, due to the Serrano lawsuit, and we have fewer kids in public school as a percent, a rich tax base, but our schools are severly underfunded. This is because much of our property tax is redistributed to other districts and no account is taken for the higher standard of living in San Francisco. If this would overturn Serrano, I’m all for it, but I see it only mentioning events since 2004. Let a City use it’s property taxes for schools, great idea, fair. However, the argument before was that some areas are far richer than others. What would be the end result?

Replies

Jennifer Bestor 10 years ago10 years ago

Floyd, no property taxes are put in a pot from San Francisco and redistributed anywhere other than ... San Francisco! The fact that you pay police and fire much more relative to other cities, and teachers much less, has to do with AB8 -- not Serrano. AB8 was the 1979 Legislative solution to Prop 13. It cut the proportion of property taxes going to schools across California from 53% (pre- and immediately … Read More

Floyd, no property taxes are put in a pot from San Francisco and redistributed anywhere other than … San Francisco! The fact that you pay police and fire much more relative to other cities, and teachers much less, has to do with AB8 — not Serrano. AB8 was the 1979 Legislative solution to Prop 13. It cut the proportion of property taxes going to schools across California from 53% (pre- and immediately post-Prop 13) to 39% — by telling cities and counties to top themselves up from the schools’ share of property taxes. Relatively expensive city/counties like SF, LA and Alameda dug deep into school property taxes, while less expensive city/counties like San Diego, San Mateo, and Santa Clara didn’t. In San Francisco, only 12.4% of your property taxes were directly allocated to your schools after AB8. (Compare that with the state’s 39% average.) Redevelopment then chipped away on both a state and local level, until the state went broke in the early 1990’s and had to claw everything back into county-wide Educational Revenue Augmentation Funds. These funds were used to backfill revenue limit districts in each county — but only within that county. So SF’s ERAF (21.6% of total property tax) was used to backfill SFUSD and CCSF — but nowhere else. (In San Mateo, for example, ERAF was collected throughout the county, then backfilled the schools in East Palo Alto, Redwood City, Daly City, Pacifica, etc. — but not the basic-aid schools in Woodside, Menlo Park, Portola Valley, etc.)

Floyd Thursby 10 years ago10 years ago

Jennifer, is there anything San Francisco could do about this, or the State? Would it be legal for San Francisco to decide to put general fund money into their schools to supplement them, or would that be illegal? Or is it only legal if from a parcel tax? Does it lead to more money being available to San Francisco for everything else? Also, will the new system be better for San … Read More

Jennifer, is there anything San Francisco could do about this, or the State? Would it be legal for San Francisco to decide to put general fund money into their schools to supplement them, or would that be illegal? Or is it only legal if from a parcel tax? Does it lead to more money being available to San Francisco for everything else? Also, will the new system be better for San Francisco?

Do you understand my complaint? A rich City with few children, well some balance should come from that. In SF, many go private, which hurts the public schools substantially, and many move as their kids get older which also hurts, not just by numbers, but because richer and whiter people tend to do these things much more and each one that leaves hurts those left behind by cutting what would be PTA donations, a good example, etc. It’s white flight plus private flight, a double whammy. If when some leave, the rest got more money, it could be a balance. Is there any way things could change so SF was able to get more due to this fact? It seems if these events hadn’t taken place, SF would have far more money per pupil. For instance, in NYC, they have over 50% more per pupil, and cops earn about a third less, it’s essentially reversed. In San Diego, cops make less by far, teachers make a little more, in absolute dollars, far more in real dollars including cost of living. What should be done about this?

Paul 10 years ago10 years ago

Floyd, San Francisco is one of the rare California cities that *does* contribute general fund money to a school district. In 2004, San Francisco voters endorsed the existing practice by approving Proposition H, a City Charter amendment that created the Public Education Enrichment Fund. Way to go, San Francisco! Historically, City funding allowed SFUSD to pay teachers a bit more than other school districts in the immediate area (more than Oakland, exactly on par with San … Read More

Floyd, San Francisco is one of the rare California cities that *does* contribute general fund money to a school district. In 2004, San Francisco voters endorsed the existing practice by approving Proposition H, a City Charter amendment that created the Public Education Enrichment Fund. Way to go, San Francisco!

Historically, City funding allowed SFUSD to pay teachers a bit more than other school districts in the immediate area (more than Oakland, exactly on par with San Leandro, and below Menlo Park, Pleasanton, etc.). Old versions of the teachers’ salary schedule used to show the portion underwritten by the City. Given that San Francisco is a very-high-cost city and that SFUSD has many low-performing, hard-to-staff schools, City funding certainly helps with teacher recruitment.

Jennifer, thank you for your thorough history of property tax allocation, post-Proposition 13. I’m a nerd who loves studying this stuff, and even I learned something new. While much has been written about the political aspects of Proposition 13, and while its direct provisions are well-known, Sacramento’s increasingly desperate efforts to back-fill the lost revenues in the years following implementation are largely forgotten.

navigio 10 years ago10 years ago

Are PEEF funds really used to increase teacher salary? Or are they more used to cover other areas that free up money for the district to use as it pleases? Generally speaking, it would be useful to understand what restrictions exist to using non-education funding to for education (though given that cities and counties are already fighting this measure my guess is giving them just the freedom would not be sufficient). Floyd, there are two ways … Read More

Are PEEF funds really used to increase teacher salary? Or are they more used to cover other areas that free up money for the district to use as it pleases? Generally speaking, it would be useful to understand what restrictions exist to using non-education funding to for education (though given that cities and counties are already fighting this measure my guess is giving them just the freedom would not be sufficient).

Floyd, there are two ways to bypass Serrano: parcel taxes and basic aid. But from a policy perspective, I think its a bad idea to focus on ways to increase the disparity in school funding. Perhaps introducing a cost of living metric to the funding system (ie, fund headcount rather than fixed cost) might help address it. But disparities in funding will always be attacked as inherently inequitable, at least from a policy perspective (basic aid and parcel taxes seem just fine–surprisingly–to most people).

Manuel 10 years ago10 years ago

navigio, are you saying that Serrano is dead law? Are the parcel taxes collected by various districts actually bypassing Serrano? Is the same happening at basic aid districts? I am under the impression that Beverly Hills USD residents, for example, had to set up an educational foundation to supplement the Serrano-imposed limits, which may, in itself, be illegal. But then this means that their property taxes did not allow them to surpass the limits set by … Read More

navigio, are you saying that Serrano is dead law? Are the parcel taxes collected by various districts actually bypassing Serrano? Is the same happening at basic aid districts?

I am under the impression that Beverly Hills USD residents, for example, had to set up an educational foundation to supplement the Serrano-imposed limits, which may, in itself, be illegal. But then this means that their property taxes did not allow them to surpass the limits set by Serrano.

OTOH, is there any enforcement of the Serrano decision other than having the state promulgate the Revenue Limit, now in its way out due to LCFF?

navigio 10 years ago10 years ago

Serrano isn't dead. It just only applies to communities without means or power. If you have those things you pretty much get to do what you want. Serrano applies to state aid. Basic aid districts don't get state aid (except for a tiny default amount) and parcel taxes come after state aid calculations. Ironically, there is nothing prohibiting a basic aid district from having a parcel tax and/or educational foundation to supplement even the relatively insane … Read More

Serrano isn’t dead. It just only applies to communities without means or power. If you have those things you pretty much get to do what you want.