Black teachers: How to recruit them and make them stay

Lessons in higher education: What California can learn

Keeping California public university options open

Superintendents: Well-paid and walking away

The debt to degree connection

College in prison: How earning a degree can lead to a new life

Rework your talking points, Governor. You risk losing the message war over Proposition 30.

That’s one implication of the latest poll on Jerry Brown’s tax initiative for the November ballot. Most Californians continue to back it, but not by a comfortable majority. Pollsters are predicting a tight race to the finish.

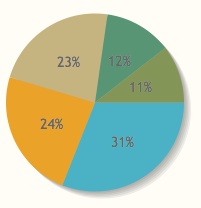

In the PACE/USC Rossier poll, 31 percent (blue) said they’d strongly support Proposition 30 and 24 percent somewhat support it (orange), while 23 percent strongly oppose (brown) and 12 percent somewhat oppose (green), with the rest undecided.

According to the online poll by Policy Analysis for California Education (PACE) and the USC Rossier School of Education of 1,041 likely voters, 54.5 percent say they favor and 35.9 percent say they oppose Prop 30, with 9.6 percent undecided – results that are in line with other recent surveys.

But when asked to choose which resonates with them more – the basic pitch that Brown and his allies are making or the arguments of the Prop 30 opponents – by 49 to 35 percent, poll respondents agreed with the anti-taxers, with 16 percent unsure.

Brown faces a dilemma. The initiative would raise an average of $6 billion per year by raising the sales tax a quarter cent for four years and increasing the income tax for seven years on those earning more than $250,000 per year. Despite years of cuts in state and education spending due to declining state revenue, many voters believe there is waste in Sacramento. Opponents led by the Howard Jarvis Taxpayers Association are hitting hard on that theme, highlighting billions of dollars for the bullet train, a $53 million account hidden in the State Parks and Recreation budget, and raises for senior legislative staff. “State spending is out of control, and the Sacramento politicians want to send you the bill,” Jon Coupal, president of the Association, intones in a 30-second radio ad.

In the TV ad, Brown calls for passing Proposition 30 to protect budgets for schools and public safety.

In a 90-second TV ad that was played to the poll respondents, Brown doesn’t talk about what he’d do with the extra revenue. He and the everyday Californians featured in the ads stress broadly protecting schools and public safety and ask voters to “take a stand” for California.

But after hearing the TV ad and the Howard Jarvis radio ad, support for Prop 30 among respondents to the PACE/USC Rossier poll declines 2.1 percentage points to 52.3 percent, dangerously close to the minimum 50 percent threshold; the opposition falls by the same amount, and the undecideds jump more than 4 percentage points, to 13.9 percent.

Brown has written Prop 30 so that K-12 schools and higher education would take the full $6 billion hit if the initiative fails, essentially holding education for ransom. Having chosen that strategy, the campaign has yet to make vividly clear the impact on students and their futures of losing the equivalent of three weeks of the school year in K-12, as well as the impact of higher tuition and decimated programs in community colleges and the CSU and UC systems.

Brown hasn’t made a strong argument for more money for K-12 schools. (Attorney Molly Munger has, but only 40 percent of respondents in the PACE/USC Rossier poll back her initiative, Prop 38, which would generate $10 billion per year by raising the income tax on all but the lowest earners.) And yet Brown could make the case that likely voters’ top preferences for using new education money, if either of the propositions passes, are essentially his. Respondents said they would:

If Prop 30 passes, Brown plans to reduce the debt that the state owes its schools, through late payments, so that schools will then have more revenue on time in future years.

In a previous USC poll in May and again in this poll, voters, by a two-to-one margin, also indicated support for another of Brown’s education priorities: spending more money for economically disadvantaged children. Brown tried to get his weighted student funding through this year and will be back again next year. That’s another credible argument for more money for schools – one that Brown has yet to make.

What may save Prop 30 is not the message but money.

“The real key here is funding,” said poll director Dan Schnur, who also directs USC’s Jesse M. Unruh Institute of Politics. “Few campaigns win where they don’t outspend the opponents.” With the California Teachers Association, the California Federation of Teachers, and California Nurses Association each kicking in more than $1 million, the Yes on 30 campaign and related efforts have raised more than $20 million already, while opponents are struggling to reach $1 million. (See running totals of the contributions.)

However powerful their message, opponents will struggle to be heard.

Beside the November election, respondents were asked questions about technology, career and technical education and the state of schools in general.

Among the findings:

Career education: Voters have a somewhat outdated view of career technical education, such Partnership Academies that prepare students for college or the workforce; 48 percent said that CTE is for students who aren’t good at academic subjects, while 45 percent disagreed. Ninety percent said students should be taught practical skills so that they can get jobs after graduating from high school.

Technology: 57 percent endorsed the idea that students spend part of every day working independently online but only 38 percent agreed with the idea that students should be able to take classes online instead of going to school. Asked if technology will reduce the cost of education in California schools, 48 percent agreed, and 34 percent disagreed.

Panelists discussed dual admission as a solution for easing the longstanding challenges in California’s transfer system.

A grassroots campaign recalled two members of the Orange Unified School District in an election that cost more than half a million dollars.

Legislation that would remove one of the last tests teachers are required to take to earn a credential in California passed the Senate Education Committee.

Part-time instructors, many who work for decades off the tenure track and at a lower pay rate, have been called “apprentices to nowhere.”

Comments (21)

Comments Policy

We welcome your comments. All comments are moderated for civility, relevance and other considerations. Click here for EdSource's Comments Policy.

Milan Moravec 12 years ago12 years ago

Einstein on Prop. 30, Prop. 38 – “Spending more money on doing what has been done in the past and hoping for a better outcome is insanity”.

Have the innovative, thoughtful, insightful, creative teachers and faculty create methodologies to increase learning with significantly reduced resources $. Be American do more with less!

No on 30, No on 38 and No on 32

YourNameHere 12 years ago12 years ago

LOL! For decades now, California's politicians have shown that they have been utterly incapable of keeping their spending in check, and yet there are still people out there like @GaryRavani who wants us all to believe that the problem is actually a "lack of revenue" caused by Prop 13. Unbelievable. Sir, Prop 13 is the LAST bulwark protecting the homeowners of this state from Sacramento's insatiable and ever-increasing need for cash. When the majority of Californians … Read More

LOL! For decades now, California’s politicians have shown that they have been utterly incapable of keeping their spending in check, and yet there are still people out there like @GaryRavani who wants us all to believe that the problem is actually a “lack of revenue” caused by Prop 13. Unbelievable.

Sir, Prop 13 is the LAST bulwark protecting the homeowners of this state from Sacramento’s insatiable and ever-increasing need for cash. When the majority of Californians finally start thinking like you do — and that time is near, sadly — this state will be finished.

JSesbastian 12 years ago12 years ago

Californian taxpayers spend $22B a year providing services to illegal aliens. Don’t you think we should eliminate these losses due to theft/embezzlement of our services before we cough up more of our hard earned paychecks?

Gary Ravani 12 years ago12 years ago

"Taxes are what we pay for civilized society." Oliver Wendell Holmes You can kind of get a view on which end of the "civilized" continuum people stand on by their reactions in certain discussions. Down near the O.W. Holmes side or way down there with good ol' Attila. The fine members of the Jarvis organization: Darn! If it wasn't for that bullet train and the park "scandal,' why they'd be on the side of the angel's and want … Read More

“Taxes are what we pay for civilized society.”

Oliver Wendell Holmes

You can kind of get a view on which end of the “civilized” continuum people stand on by their reactions in certain discussions. Down near the O.W. Holmes side or way down there with good ol’ Attila.

The fine members of the Jarvis organization: Darn! If it wasn’t for that bullet train and the park “scandal,’ why they’d be on the side of the angel’s and want to (eventually) move CA’s funding per student up from 47th in the nation.

Right.

Then there’s the billions in matching funds CA would have lost if it didn’t go forward with the bullet rain. Or that the money found in the park fund, if transferred to education could have plugged two tenths of one per cent of just the education cuts made since 2008.

Whatever.

The real gun to the head of education in CA has always been Prop 13, business tax cuts, and a generally low revenue stream in the state with the second highest cost of living in the nation (Hawaii #1).

CA’s taxes paid as a percentage of personal income ranks it about 15th from the top of the 50 states. It does have high sales taxes and personal income taxes, but it has low property taxes, as well as lower than average vehicle, fuel, tobacco, and alcoholic beverage taxes. A rank of 15 puts the state closer to the national median than to the top.

Then there’s the always popular public employee pensions to kick around. After all the current state obligation to pensions is a whole 3.9% of the state budget. We have all seen instances of the 4% tail wagging the 96% dog, haven’t we? Haven’t we?

CA’s low revenue stream and high cost of living, compounded by the finance industry driven recession, have created a budget deficit. The situation is further complicated by the requirement to get a few members of the (very) minority party to support revenue enhancement. Cuts are the option the Governor says he will use to resolve that problem and the cuts will be to education. Perhaps that will bring the state’s school spending to 50th in the nation. That should make the minority party, the Jarvis people, and (somewhere) Attila cheer up. It would be a tragedy for the children of CA. O.W. Holmes would shed tears.

The only thing dishonest in this discussion are the statements made by those who suggest they can’t understand that “new” revenues will backfill possible new school cuts (as well as previous cuts). It’s not rocket science.

Bill Tuck Jr 12 years ago12 years ago

Governor Brown makes really Stupid Mistakes and is not Qualified to lead California. He will leave office as the Worst Governor in our States History. So Sad for our Schools and Public Safety!!

Navigio 12 years ago12 years ago

It's interesting, some districts were able to budget as if the prop would pass (without being qualified) but accompanied that with massive cuts that will create utter chaos later in the year if it fails. The irony of such an approach is that community members see the lack of immediate cuts (at least not commensurate with the doomsday scenario they hear in the media) and figure things must not be so bad and thus think the … Read More

It’s interesting, some districts were able to budget as if the prop would pass (without being qualified) but accompanied that with massive cuts that will create utter chaos later in the year if it fails.

The irony of such an approach is that community members see the lack of immediate cuts (at least not commensurate with the doomsday scenario they hear in the media) and figure things must not be so bad and thus think the taxes are not needed. ‘Punishment’ for trying to keep the cuts away from the kids.

Bea 12 years ago12 years ago

@el is right about the deferrals. County Offices of Education charged with approving local districts' budgets are demanding ever steeper cuts to programs and reductions in staff to ensure that districts show positive balances three years out. Although Governor Brown asked districts to budget as though the tax measure would pass, County Offices are forcing districts to submit budgets based on its failure and without restoring deferred funds. These doomsday budgets to avoid qualified or negative … Read More

@el is right about the deferrals. County Offices of Education charged with approving local districts’ budgets are demanding ever steeper cuts to programs and reductions in staff to ensure that districts show positive balances three years out. Although Governor Brown asked districts to budget as though the tax measure would pass, County Offices are forcing districts to submit budgets based on its failure and without restoring deferred funds.

These doomsday budgets to avoid qualified or negative certification (and threats of jack-booted FCMAT overseers) are demoralizing to teachers and students and erode public confidence in our neighborhood schools. It’s an absurd and destructive kabuki.

el 12 years ago12 years ago

The payment deferrals may not seem like that big a deal to some, but they are creating real cash flow problems for California schools that are in fact creating more work and starving programs that are ostensibly budgeted.

Osahon 12 years ago12 years ago

No one quite knows exactly where the money from Prop 30 is going. The governor can’t give us a straight answer about it. The first place I would look though is the donors to the campaign.

http://www.kcet.org/news/ballotbrief/elections2012/propositions/database-whos-funding-prop-30-temporary-tax-to-fund-education.html

oh look, it’s a bunch of Public unions. I wonder why they would endorse a measure to raise taxes on the rest of us? Here’s a guess: To pay off their pensions.

http://www.bloomberg.com/news/2012-04-23/new-california-taxes-pay-for-pensions-not-schools.html

Replies

John Fensterwald 12 years ago12 years ago

Osahon and Jordan: I have written extensively about the Calstrs pension liability (check calstrs in the TOP-ed.org library for other stories) and have pointed out that, unless a court rules otherwise regarding changing pension rules for existing CalSTRS members, taxpayers will be on the hook potentially for billions of dollars annually in additional payments into the pension system. But it is inaccurate to say that all or even most of the money raised from Prop … Read More

Osahon and Jordan:

I have written extensively about the Calstrs pension liability (check calstrs in the TOP-ed.org library for other stories) and have pointed out that, unless a court rules otherwise regarding changing pension rules for existing CalSTRS members, taxpayers will be on the hook potentially for billions of dollars annually in additional payments into the pension system. But it is inaccurate to say that all or even most of the money raised from Prop 30 will go to higher teachers’ pensions. That said, legislators should recognize the frustration many taxpayers feel regarding pension obligations and act next week to reform the system (raising the retirement age and putting a cap on pensions). A failure to act could doom Prop 30.

It is also wrong to say money from Prop 30 will not reach the classroom. I refer to the LAO analysis of Prop 30. There would be no revenue from the proposition this year, since the revenue would be used to start paying down deferrals. As the LAO stated, “A large share of the revenues generated by this measure is spent on schools and community colleges. This helps explain the large increase in funding for schools and community colleges in 2012-13—a $6.6 billion increase (14 percent) over 2011-12. Almost all of this increase is used to pay K-14 expenses from the previous year and reduce delays in some state K-14 payments.” In future years, money will go directly to the schools.

Jordan 12 years ago12 years ago

It is just sad that Brown attempts to gain support for this initiative by holding a gun to education’s head. “I will shoot education if you do not approve this!” Is this really the way to gain support for an initiative? If this was truly beneficial for California, he would emphasize the positive aspects, instead of invoking scare tactics. The fact remains, NONE of the money raised by Proposition 30 will make it to the … Read More

It is just sad that Brown attempts to gain support for this initiative by holding a gun to education’s head. “I will shoot education if you do not approve this!” Is this really the way to gain support for an initiative? If this was truly beneficial for California, he would emphasize the positive aspects, instead of invoking scare tactics. The fact remains, NONE of the money raised by Proposition 30 will make it to the students who desperately need it. The money will go to the general fund, which Sacramento severely mishandles. It also offers no real reforms to education, which are necessary to get our schools back on track. Once people discover his facade, any support for this proposition will flush down the toilet. No wonder he is having a hard time selling this to voters. They want to hear positives, not scare tactics. They are not fooling anyone.

mcdez 12 years ago12 years ago

Proposition 38 puts the money right in the classroom, where it belongs. It is time to stop engaging parents and communities in heartbreaking decisions on how to cut more out of our schools and start engaging parents and communities in the important decisions on how we can restore programs and services in every school in California. Our children deserve more than just preventing deeper cuts. Our children deserve more than a new normal that maintains school … Read More

Proposition 38 puts the money right in the classroom, where it belongs. It is time to stop engaging parents and communities in heartbreaking decisions on how to cut more out of our schools and start engaging parents and communities in the important decisions on how we can restore programs and services in every school in California.

Our children deserve more than just preventing deeper cuts. Our children deserve more than a new normal that maintains school funding at a level way below the national average. Proposition 38 starts to restore the California dream of a quality education for all our children. It truly establishes restoring and increasing education funding as the top priority.

navigio 12 years ago12 years ago

So munger's approval rating is rising? Wasnt it in the 30's recently? I think prop 30 is in trouble. I agree with the comments that the rhetoric in favor of 30 is a lie. And the cons miss the point in the other direction. I guess this isnt surprising as a lot of political is untruthful. Unfortunately there is a lot more at stake at the moment. My opinion is that Brown is trying to maintain … Read More

So munger’s approval rating is rising? Wasnt it in the 30’s recently?

I think prop 30 is in trouble. I agree with the comments that the rhetoric in favor of 30 is a lie. And the cons miss the point in the other direction. I guess this isnt surprising as a lot of political is untruthful. Unfortunately there is a lot more at stake at the moment.

My opinion is that Brown is trying to maintain the health of the state in general, but knows people dont care so much about that (or wont believe him regardless) so he’s trying to use education as the ‘argument’. I’ve always felt because of that its possible his threats were a bluff. However, they’ve signed the budget now, so now it seems he’s all in..

The irony is that in a society where market forces push the cost of labor down so far that huge portions of society cant even afford to pay income taxes (though they pay other taxes, including sales), there will be a lot of people who will vote for tax increases regardless. Perhaps if more people were paid living wages the no-tax rhetoric would resonate with more people.

el 12 years ago12 years ago

I don’t know where more money will come from if not from this initiative. Feel free to explain how you’ll get $6 billion out of the $329 million state park system.

Rosie 12 years ago12 years ago

Brown can’t make a strong statement about how Prop 30 will help schools because IT WON’T! Prop 30 will go to pension funds and more government waste. Remember when the lotto was supposed to have education set for life? Sacramento can’t be trusted to spend our money on schools.

Replies

Lenea 12 years ago12 years ago

I agree with you Rosie. Prop 30 money would just go to pay for the already negotiated increases on teacher pensions. While they work hard and deserve the money they definitely should have come up with the money before they agreed to pay for the increase. Now CA voters are in an impossible situation. Agree to pay for more taxes to this corrupt system or education is on the cutting block…

Janae Price 12 years ago12 years ago

I am not the least bit surprised to hear about the struggle. In fact it is about time, voters are coming to realize that Prop 30 is not at all what it seems.It is and will remain as a $47billion tax hike without any reforms and no NEW money for schools!

el 12 years ago12 years ago

Technology is not going to reduce costs; truly, the interest in technology has to be about improving outcomes. I think one of the most compelling numbers for selling the tax increase is to look at the top line gross budget number, which has decreased by a substantial percentage even while demand for services has not declined. If you compare state government employees per capita, we're pretty low. There really is just a lot less money … Read More

Technology is not going to reduce costs; truly, the interest in technology has to be about improving outcomes.

I think one of the most compelling numbers for selling the tax increase is to look at the top line gross budget number, which has decreased by a substantial percentage even while demand for services has not declined. If you compare state government employees per capita, we’re pretty low. There really is just a lot less money to work with in Sacramento than there used to be.

Replies

navigio 12 years ago12 years ago

I agree with both your points, and I think the first one is particularly important because many people have a desire to do nothing more than reduce the 'burden' of public education on the taxpayer. I also believe a huge problem is that people use online buying to bypass sales taxes. I know many people who dont even know this is against the law. CA is trying to remedy this but now that the cats out … Read More

I agree with both your points, and I think the first one is particularly important because many people have a desire to do nothing more than reduce the ‘burden’ of public education on the taxpayer.

I also believe a huge problem is that people use online buying to bypass sales taxes. I know many people who dont even know this is against the law. CA is trying to remedy this but now that the cats out of the bag, even getting what they consider ‘due’ will feel like an increase.

Paul 12 years ago12 years ago

California is around the fifth highest taxed state in the union and if prop 30 goes through we will be number 1. Your argument that somehow California is frugal is laughable. They move money around in different funds so a year to year comparison is useless. We have so much money we can build a bullet train to no where, give our legislature a raise, and now they are working on extending … Read More

California is around the fifth highest taxed state in the union and if prop 30 goes through we will be number 1. Your argument that somehow California is frugal is laughable. They move money around in different funds so a year to year comparison is useless. We have so much money we can build a bullet train to no where, give our legislature a raise, and now they are working on extending insurance for work related illness. The gross numbers for this year went up. You would at least expect that they could hold things flat.

jordanmagill 12 years ago12 years ago

Whatever your politics, the problem with Prop 30 remains the DISHONESTY. The politicians say that the money is for schools, but newspapers agree that it will mean ZERO new dollars for our classrooms. http://www.bloomberg.com/news/2012-04-23/new-california-taxes-pay-for-pensions-not-schools.html At the same time, its backers pretend like it doesn't include a sales tax hike that will not only hurt our economy, but basically hands a lead weight to the most vulnerable among us, families that are now just barely treading water. Californians … Read More

Whatever your politics, the problem with Prop 30 remains the DISHONESTY. The politicians say that the money is for schools, but newspapers agree that it will mean ZERO new dollars for our classrooms.

http://www.bloomberg.com/news/2012-04-23/new-california-taxes-pay-for-pensions-not-schools.html

At the same time, its backers pretend like it doesn’t include a sales tax hike that will not only hurt our economy, but basically hands a lead weight to the most vulnerable among us, families that are now just barely treading water.

Californians want honesty. Tragically, all they get from this proposition is a steaming pile of cynicism.