Source: California Channel webcast

Source: California Channel webcastGov. Jerry Brown got the bottom line he wanted faster than expected.

Brown and legislative leaders announced a budget deal Tuesday, one day after state lawmakers approved spending $2 billion beyond what the governor said he’d accept. The final agreement will not alter the record education spending that Brown proposed through Proposition 98, the voter-approved formula that determines revenue for some preschool programs, K-12 schools and community colleges.

Lawmakers did obtain some concessions within the $115.4 billion spending plan Brown presented last month: 7,000 additional full-day preschool slots and 6,800 more childcare vouchers that parents can use to pay daycare providers; and 10,000 additional students at the California State University and 5,000 more students at the University of California, if UC meets conditions that Brown is requiring. Senate President pro Tem Kevin de León, D-Los Angeles, called this extra money for the “book ends” of students’ education critical to providing children “a fair shot” at success.

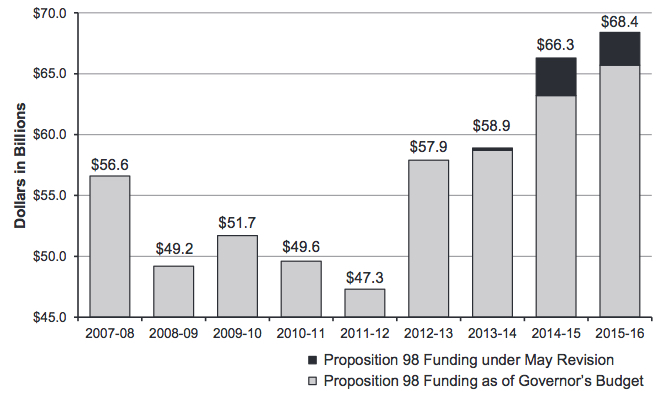

After years of cuts in education funding following the recession, the $68.4 billion for Prop. 98 in the coming year is a remarkable turnaround. The 12.3 percent increase is $7.5 billion more than the $60.9 billion last year.

California Department of Finance

Proposition 98 funding for K-12 schools and community colleges has recovered dramatically since the low of $47 billion in 2011-12 to what would be a high of $68.4 billion next year. The black bar represents revised estimates of Prop. 98 revenue for three years in Gov. Brown’s May budget proposal, which the Legislature agreed to.

One-time and ongoing appropriations for K-12 schools and community colleges will total $14 billion next year. This includes revised revenue estimates for the current year, after school districts’ budgets were already set. A third of the money will go to pay off debts to schools built up during the recession.

Highlights of spending next year for education include:

- $6.1 billion added to the $47 billion appropriated last year – a 13.2 percent increase – for schools to spend through the Local Control Funding Formula, the new finance system providing general funding. That’s an average of $1,088 more per student for an average district, in which 63 percent of English learners and low-income children receive

extra money under the formula. - $500 million in one-time spending for teacher development. That’s part of the final agreement Brown made with de León and Assembly Speaker Toni Atkins, D-San Diego. It will reduce the $3.5 billion that Brown had proposed in repayments to districts for past mandated expenses. Districts will receive the money on a per-teacher and per-administrator basis. They can use the funding over three years to provide training in the Common Core and other new academic standards, to support new teachers and principals or struggling teachers identified through Peer Assistance and Review programs, and to train mentor principals and teachers.

- More than $1 billion over three years for new career and technical education initiatives, including $400 million next year for a new proposal, the Career Technical Education Incentive Grant Program. It will promote regional partnerships to meet emerging workforce needs.

- $60 million in new funding to expand interventions for special-needs children ages birth to 2, an additional 2,500 part-day preschool slots and an expansion of schoolwide behavioral supports – all recommended by the Statewide Special Education Task Force, which issued its report in March.

- A $10 million increase in Foster Youth Services, which now receives $15 million from the state. The increase plus a change in the law will allow foster youth who live with relatives to receive counseling and tutoring.

- $4 billion in debt repayment. This includes $3 billion for unpaid state mandates and $1 billion in the final repayment for deferrals – late payments that required schools to borrow money.

- $7.9 billion for community colleges, up about $700 million from a year ago. The Legislative Analyst’s Office calculated that funding per full-time equivalent student would be $6,764 in the coming year, $724 per student above – 12 percent– the pre-recession level.

Responding to a strong push from business and community groups, early education advocates and legislators, Brown agreed to allocate $265 million for early education that included an increase in reimbursement rates by 5 percent to preschool and childcare providers, and by 4.5 percent to providers paid by vouchers.

“If you look at it from what the kids need, we have a long ways to go,” said Ted Lempert, president of Children Now, an advocacy group based in Oakland that got 350 organizations to sign a letter to the governor on behalf of early education. “But if you look at it from what we were expecting, it’s strong. The Legislature threw together a really strong package, and the bulk of the package is in there and that’s great.”

The 7,000 new slots — plus the 2,500 part-day preschool slots for children with exceptional needs — are a step toward a goal of 31,500 slots needed to provide preschool for every 4-year-old from a low-income family.

The number of childcare vouchers needed is not clear, said Giannina Perez, director of early learning and development policy for Children Now. In June 2011, the state disbanded its waiting list for low-income families who needed help with childcare costs, Perez said. At the time, that list had 200,000 eligible families, she said.

Of the $265 million total, $100 million will now be part of the Prop. 98 guarantee, something the early education advocates had wanted because of the recent huge influx of funds into Prop. 98 compared with the rest of the state budget. Education groups, such as the California Teachers Association and the California School Boards Association, had opposed adding more preschool funding into the guarantee for K-12 schools and community colleges.

Brown did not allocate an additional $25 million for the state’s $550 million fund for after-school programs as legislators had proposed. The program has not seen an increase since it was first implemented in 2006.

The fat budget years for education are expected to level off with the expiration of temporary taxes under Proposition 30. Surging revenues have enabled the state to pay back most of the more than $10 billion in Prop. 98 allocations owed to districts in past years, called the maintenance factor. But districts are still owed $700 million, and that amount is expected to grow post-Prop. 30.

Because the Local Control Funding Formula steers additional money to districts based on their enrollments of “high-needs” children – low-income students, English learners and foster youth – some have caught up to or surpassed pre-recession spending levels, adjusted for inflation, but others still have not.

To get more reports like this one, click here to sign up for EdSource’s no-cost daily email on latest developments in education.

Comments (20)

Comments Policy

We welcome your comments. All comments are moderated for civility, relevance and other considerations. Click here for EdSource's Comments Policy.

Dawn Urbanek 9 years ago9 years ago

Does it really matter what "record" spending there is? Not really- all Districts are capped at 2008 levels. So my District can expect to increase to a maximum of $8,500 by 2021. This record spending is going to new entitlement programs and employee compensation. At $8,500 my District will be lucky to afford the employee compensation increases from now to 2021 + the CalSTRS and CalPERS contributions - If we for some reason run short … Read More

Does it really matter what “record” spending there is? Not really- all Districts are capped at 2008 levels. So my District can expect to increase to a maximum of $8,500 by 2021. This record spending is going to new entitlement programs and employee compensation. At $8,500 my District will be lucky to afford the employee compensation increases from now to 2021 + the CalSTRS and CalPERS contributions – If we for some reason run short – I can only imaging class sizes of 60 to keep pace.

But no one cares about the quality of education my child receives because I just happen to live in a wealthy area.

Gary Ravani 9 years ago9 years ago

Professional development dollars will be distributed on a per teacher basis, which makes sense as professional development will be for teachers. It does have a strong hint of “categorical funding” though, not that specific funding streams are always a bad thing.

Or were a bad thing for that matter.

Replies

Don 9 years ago9 years ago

“Professional development dollars will be distributed on a per teacher basis, which makes sense as professional development will be for teachers.”

Supplemental and Concentration dollars will be distributed on a per student basis, which makes sense as compensatory education will be for students.

Don 9 years ago9 years ago

“….money will be distributed on a per certificated teacher basis….so in the end districts will probably get about the same amount, had it been by a per-student basis”

That would be true if average district class sizes were the same between districts.

Kim 9 years ago9 years ago

I'd also love to better understand the impact of putting $100 million of the childcare into the Prop 98 guarantee. Doesn't that decrease something that was in the May Revise that was going to districts? And I assume that the $601 per ADA in mandated cost repayment is now something like $516 per ADA with the rest being allocated slightly differently to districts for the teacher development. Any idea if these teacher funds will … Read More

I’d also love to better understand the impact of putting $100 million of the childcare into the Prop 98 guarantee. Doesn’t that decrease something that was in the May Revise that was going to districts?

And I assume that the $601 per ADA in mandated cost repayment is now something like $516 per ADA with the rest being allocated slightly differently to districts for the teacher development. Any idea if these teacher funds will be considered restricted or still unrestricted but one-time?

Replies

John Fensterwald 9 years ago9 years ago

Kim and SD Parent: The Ed Coalition was quite effective in preventing non-K-12 programs from being pushed into Prop.98. The Department of Finance insisted that the $100 million for early education that is included in Prop. 98 will come from administrative "efficiencies," not at the expense of other programs. I guess we will have to take their word for it. You are right that the $500 million for teacher development will be restricted money, though … Read More

Kim and SD Parent: The Ed Coalition was quite effective in preventing non-K-12 programs from being pushed into Prop.98. The Department of Finance insisted that the $100 million for early education that is included in Prop. 98 will come from administrative “efficiencies,” not at the expense of other programs. I guess we will have to take their word for it.

You are right that the $500 million for teacher development will be restricted money, though broadly defined to include professional development for Common Core and BTSA for new teachers. Therefore, the unrestricted $3.5 billion that Brown had proposed as mandate reimbursement will now be $3 billion, so the ADA will be less. The teacher development money will be distributed on a per certificated teacher basis, I am told (I haven’t read the trailer bill), so in the end districts will probably get about the same amount, had it been by a per-student basis.

Prop. 30 did more than advertized: It brought in as much as $8 billion per year to the General Fund in taxes on the rich because of the booming stock market. Because of how Prop. 98 works, this year all of the money went to K-12 and community colleges, in large part to repay schools for past Prop. 98 allocations that districts didn’t get. Now that most of that “debt” — known as the maintenance factor — has been paid off, the percentage of Prop. 30 going to schools will likely revert to the norm, about 40 cents on a dollar, as long as Prop. 30 remains on the books.

Brown has made funding the Local Control Funding Formula his top priority, with more than 80 percent of Prop. 98 dollars going to it. Those are unrestricted dollars. I assume he will keep his vigilance to prevent categoricals from working their way back into the budget as long as he is governor. What happens after he leaves is anyone’s guess. Charter schools, which he has protected, are also anxious about the post-Brown years.

SD Parent 9 years ago9 years ago

Thank you, John, for the expanded information. I understand the relative amounts of Prop 30 funding going to education. My question was more about how much revenue (in billions) is Prop 30 generating at the moment (through sales tax and PIT). As you know, these billions will disappear in a few years; in fact, the Prop 30 revenue derived from PIT could drop precipitously in any given year if the market were … Read More

Thank you, John, for the expanded information. I understand the relative amounts of Prop 30 funding going to education. My question was more about how much revenue (in billions) is Prop 30 generating at the moment (through sales tax and PIT). As you know, these billions will disappear in a few years; in fact, the Prop 30 revenue derived from PIT could drop precipitously in any given year if the market were to drop.

It’s so frustrating that K-12 education in this state relies so heavily on inherently volatile revenue sources. The Legislature needs to use some of those critical thinking skills that it espoused in Common Core to recognize this and act responsibly. Prop 30 compounds the volatility of education funding and engenders a false sense of how much funding education will have in the future based on how much it gets now. This seems to have encouraged Sacramento to add additional costs to Prop 98 (namely pension obligations and now preschool/childcare) when anyone who is paying attention knows that the floor is going to drop out in pieces starting at the end of 2016 when Prop 30 begins to expire (and could have sudden holes if the stock market were to drop).

I can tell you from the students’ perspective, even in a district with 63% LI/EL/FY, the current revenue for K-12 (with Prop 30) has not even come close to restoring programs, services, or class sizes that were present before the recession. However, extending Prop 30 is going to be a tough sell if all we have to show for it is increased employee compensation, pension payments, and childcare.

Don 9 years ago9 years ago

John, K-12 students suffered less funding as a result of past inefficiencies – so I would think they should be the recipients of savings from new efficiencies rather than early education?

navigio 9 years ago9 years ago

‘Certificated’ can also mean non-teaching staff. If so, it is different than basing it on per pupil.

Dawn Urbanek 9 years ago9 years ago

Yes it does. This budget is not about funding a basic education for EVERY student, it is about the redistribution of wealth from communities with higher percentages of tax paying residents to communities with higher percentages of illegal immigrants. This law is unconstitutional because it is not applied to every student equally- it is intentionally designed to hurt all students who live in wealthy areas irrespective of their individual wealth, race or ethnicity. What about … Read More

Yes it does. This budget is not about funding a basic education for EVERY student, it is about the redistribution of wealth from communities with higher percentages of tax paying residents to communities with higher percentages of illegal immigrants. This law is unconstitutional because it is not applied to every student equally- it is intentionally designed to hurt all students who live in wealthy areas irrespective of their individual wealth, race or ethnicity.

What about they poor, ELL and Forster kids in my district- they get $300 extra dollars? REALLY? are they getting the services they need?

navigio 9 years ago9 years ago

they get about $1500 each, though after gap reduction, thats about a thousand this year. not implying even thats enough tho..

Don 9 years ago9 years ago

Dawn, I sympathise with the plight of students of CUSD and I have great respect for the work you've done. So why am I about to criticize the comment above? First of all, redistribution of wealth as it pertains to public education is desirable within limits. It is critical that children get a fair shot at succeeding and that requires meeting needs which are not the same from one student, school or district to … Read More

Dawn, I sympathise with the plight of students of CUSD and I have great respect for the work you’ve done. So why am I about to criticize the comment above?

First of all, redistribution of wealth as it pertains to public education is desirable within limits. It is critical that children get a fair shot at succeeding and that requires meeting needs which are not the same from one student, school or district to the other. If the 14% of Prop 98 K-12 funding that pays for SC grants were distributed to all students as part of the base grant, it wouldn’t fundamentally change the equation for funding of a basic education for EVERY child. LCFF shuffles the deck, but it doesn’t do much to solve the fundamental underfunding of California education, though the Prop 30 windfall has benefited the LCFF rollout and two two are improperly conflated. It isn’t even clear whether the unduplicated students receive more compensatory assistance compared to most of former categoricals that were rolled into LCFF.

I also wonder sometimes what you mean when you refer to student services v. teacher compensation. I think of student services as the things like counseling, peer mentoring, health, crisis response,etc. When you use the term you seem to be referring to lowering class sizes as opposed to raising salaries. This is a source of confusion.

Regarding illegals, as long as millions are allowed to enter the country illegally and use the schools, roads, hospitals, jails and access most public services, including welfare services, our state will continue to underfund education.

LCFF is all about keeping the state out of education. That’s why the state defendants in Cruz. v CA are using LCFF as a legal rationale to avoid culpability. The question then is this: if the districts are accountable to uphold the state constitution what then is the purpose of the Department of Education other than that of an administrative agent and financial controller?

Elizabeth 9 years ago9 years ago

Goodness, please explore the connections between Children Now, CA Forward, CSBA, Davis School Board and Ed Source. Same funders? Board member overlap? Childcare should not be included in 98 – it is not education. Politicians need to find another funding source – it may be wise to reach out to Hillary Clinton for a few ideas.

Replies

Dawn Urbanek 9 years ago9 years ago

Why of all the people would you reach out to Hillary Clinton – she would agree with this. She is all about using K-12 to gain more revenue and the using that money to fund other programs. What new idea would she possible have? Please.

SD Parent 9 years ago9 years ago

I'm concerned that we're setting K-12 education to take another big loss in the coming years, between the expiration of Prop 98 and adding costs within Prop 98 that are not education (e.g. childcare--essentially giving some parents childcare for their kids when they are young by taking it away from all kids' educations when they turn 5--not to mention the CalSTRS liability added last year, with payments increasing every year). John, could you do an accounting … Read More

I’m concerned that we’re setting K-12 education to take another big loss in the coming years, between the expiration of Prop 98 and adding costs within Prop 98 that are not education (e.g. childcare–essentially giving some parents childcare for their kids when they are young by taking it away from all kids’ educations when they turn 5–not to mention the CalSTRS liability added last year, with payments increasing every year).

John, could you do an accounting of what exactly Prop 98 itself got in relation to what else was dumped into it (e.g. childcare is NOT education for K-14–it’s just a back-end deal to fund childcare) and how much of the Prop 98 is now restricted (e.g. Atkins’ teacher development, CCTE) compared to these figures in the Governor’s May Revise on which every district built their budget?

Also, how much Prop 98 revenue is generated by Prop 30 (by sales tax and PIT), which will be expiring in steps over the coming years? I know what the predictions were, but now that the economy has improved faster than the predictions, more of the Prop 98 funds will be disappearing when Prop 30 expires.

Thanks.

Eric Premack 9 years ago9 years ago

Seems you're missing a decimal point between the "4" and the "7" under your first bullet point of the budget highlights--last year's budget appropriated $4.7 billion, not $47 billion. Great summary otherwise, as per usual. Read More

Seems you’re missing a decimal point between the “4” and the “7” under your first bullet point of the budget highlights–last year’s budget appropriated $4.7 billion, not $47 billion.

Great summary otherwise, as per usual.

Replies

Don 9 years ago9 years ago

The number in the article is correct.

Eric Premack 9 years ago9 years ago

Yes, I misread it. The article is correct and I stand corrected. Thanks.

John Fensterwald 9 years ago9 years ago

Don and Eric:

I appreciate your attention to detail.

Dawn Urbanek 9 years ago9 years ago

John why don’t you write a factual article about how unfair the LFCC law is to ALL students who live in what are considered to live in wealthy areas.