Jordan Riley, 4, builds a tower with magnetic blocks during his state-funded afternoon class at the Creative Montessori Children’s Learning Center in East Palo Alto. Jordan’s grandfather, Willie Riley, said a new fee for the program is “a bad idea.” Credit: Lillian Mongeau, EdSource Today

A much-disputed daily fee for families with children in state-funded preschool programs will likely be removed from next year’s state budget.

Assemblymember Susan Bonilla, D-Concord, who chairs the budget subcommittee on education finance, said the fee, which was added to the budget for the first time last year to offset state costs, was a mistake. “We did it for a year and it didn’t work,” she said. “We have the opportunity to evaluate it and say the value is not there.”

After listening to testimony from experts and community members during a March 20 hearing, Bonilla’s subcommittee voted to add language eliminating the fee to the trailer bill that will modify the proposed state budget. The budget will be revised in May before being sent to the governor’s desk for approval. Generally, trailer bill amendments pass at that time as well.

Family fees for child care and full-day preschool have been on the books for years, and families now pay up to $17.76 per day for full-day state preschool programs. The fee being eliminated is for half-day state preschool, which serves more than 200,000 students a year and has been free until this year. Opponents of the half-day fee say it is a new charge for families who can ill afford it.

Like the other child care fees for state-supported programs, this one varies based on a family’s income. A family of four making below $26,000 annually, for example, can still send their children to state-funded preschool programs for free. Four-person families making between $26,000 and $37,900 pay $1 to $8.88 per three-hour school day, based on a sliding scale. Private preschools generally charge by the month and vary greatly in cost, but broken down into a per-day rate, families can expect to pay between $25 and $50 for the half-day of care.

State preschool operators from around the state who oppose charging families testified at the hearing that they have had children and families drop out of the program once they determine they cannot pay the fee. The California Department of Education does not track reasons individual families choose not to enroll in state preschool so it is unclear how many families have kept their children out because of the fee.

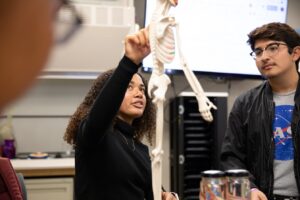

Jordy Cruz (center) and Jesus Pulido (right) listen as Rosana Duran, one of their teachers at the Creative Montessori Learning Center in East Palo Alto, reads them “The Very Hungry Caterpillar.” Credit: Lillian Mongeau, EdSource Today

Cynthia Sloane, the director of child and family services at the Santa Cruz Community Counseling Center, said it’s impossible to know exactly how many families decided not to attend her program because of the fee, but she knows it has been a deterrent for some. The program operates two half-day state preschool classrooms in Watsonville.

“We’re serving the poorest of the poor who don’t have any other options,” Sloane said. “Asking them to (pay a fee) is really a hardship on these families.”

Since state preschool doesn’t have enough funding to serve all eligible children, Sloane’s program still has a waiting list. The half-day fee, Sloane said, doesn’t bring in enough additional income to significantly impact state preschool funding.

“It would be different if we were getting a lot of money or if it was paying for itself,” Sloane said. “We’re not bringing in enough money to do any good. It’s tough on parents, it takes staff time, it generates a small amount of money, then that money goes back to the state.”

At the subcommittee hearing in March, Bonilla said the fee was meant to raise about $3.3 million for half-day state preschool. That amount is tiny compared to the preschool program’s overall budget of $481 million, she said, and doesn’t go very far toward making up the $100 million the program has lost due to state budget cuts since 2008. However, calculating the amount the program has lost is complicated by the Legislature’s decision this budget cycle to move funding for half-day state preschool from the general child care fund to the state preschool budget, which also funds full-day preschool, as the Legislative Analyst’s Office detailed.

However, not all state-funded preschool operators oppose the fees. The Creative Montessori Learning Center in East Palo Alto serves 48 children in state-funded half-day preschool. Director Gloria Marshall said the fees weren’t causing parents to disenroll their children in significant numbers.

“If I’m perfectly honest, I don’t know if it’s bad that they have to pay fees,” Marshall said. “People appreciate (the program) more. The fee tells them there’s some value.”

Students at the Creative Montessori Learning Center in East Palo Alto play and learn through various activities during their half-day state preschool class. Credit: Lillian Mongeau, EdSource Today

Leslie Juarez’s son is enrolled in the afternoon session of the half-day program in East Palo Alto. On a recent Thursday, Juarez, 29, arrived early to bring pizza and cake to share with her son’s classmates in honor of his fifth birthday. She said she didn’t mind coming up with the $1 per day she owes for her son Joshua to attend preschool here.

“I budget around his fee,” she said. “If that means we are not going to eat out on Saturday, we do that. I know this is important for him.”

Juarez said she likes the program and Joshua’s teacher and she feels lucky to have found such an inexpensive program to help her son get ready for kindergarten.

“He knows his letters and numbers and his vocabulary is growing,” she said. He’s also less shy and more willing to do things like pick up his own toys now, Juarez said. “It’s worth it for him.”

Small programs like the Santa Cruz Community Counseling Center and the Creative Montessori Learning Center have no choice but to charge the mandated fee. There’s no wiggle room in their budgets to come up with that money any other way. Larger programs though, like the one run by Fresno Unified School District, have the option of waiving the fee for families, and covering the amount that would be raised by the fee from within their district general fund.

Last fall, the Fresno school board decided “to remove the barrier” of the fee for families in their half-day state preschool program, said Deanna Mathies, the manager of early learning for the district.

Families weighed the fee, Mathies said, and determined it would come down to cutting the budget for food or paying for school for their 4-year-old. “They just couldn’t afford it,” Mathies said.

Mathies expects Fresno will owe the state $200,000 at the end of the school year, which it will cover with funds from Proposition 30, the November voter initiative to raise a tax on wealthy Californians to cover education costs.

There has been no move to eliminate the full-day state preschool or general child care fees for low-income working class families, though that may come up if President Obama’s Preschool for All proposal to greatly expand free preschool programs makes it through Congress this summer.

Lillian Mongeau covers early childhood education. Contact her and follow her @lrmongeau.

To get more reports like this one, click here to sign up for EdSource’s no-cost daily email on latest developments in education.

Comments (4)

Comments Policy

We welcome your comments. All comments are moderated for civility, relevance and other considerations. Click here for EdSource's Comments Policy.

Paul 11 years ago11 years ago

el, without wanting to insult your district, I will say that school districts tend to have high overhead. Systemic incompetence makes business functions like payroll, procurement, treasury, and in this case, accounts receivable, outrageously expensive. Why a certificated employee who taught kindergarten for five years, took the CPACE on the computer of an afternoon, filed for a preliminary administrative credential, served successfully as a curriculum coordinator or a vice principal for two years, and completed some night … Read More

el, without wanting to insult your district, I will say that school districts tend to have high overhead.

Systemic incompetence makes business functions like payroll, procurement, treasury, and in this case, accounts receivable, outrageously expensive.

Why a certificated employee who taught kindergarten for five years, took the CPACE on the computer of an afternoon, filed for a preliminary administrative credential, served successfully as a curriculum coordinator or a vice principal for two years, and completed some night school classes, should be deemed qualified to be a superintendent, an assistant superintendent of business services, or other leader charged with overseeing business functions, escapes me. Why a classified employee who worked as a secretary for a decade, then passed a 40-year-old, multiple-choice civil service test using a guidebook from the local public library, should be deemed qualified to perform business functions, likewise escapes me.

Even private organizations, which are free to hire on the basis of skill rather than government-issued credentials, seniority and civil service test results, can play games with allocation of overhead. If I wanted to make a fee seem too expensive to be worth collecting, I’d shift an accounting clerk to the project full-time, charge the annual accounting software system upgrade to the project, and even throw in a share of the in-house print-shop, because I couldn’t possibly collect the fee without designing a custom five-part carbon form. Obviously I’m joking here, but claims about overhead warrant careful scrutiny. (To pick a much more important example, was it ever really true that Grades K-3 and Grade 9 class size reduction cost districts more than the state provided? The answer hinged on how districts chose to allocate overhead.)

Small school districts — if they make sense at all — should be forming consortia to handle business functions.

Out of curiosity, why did the fee create family turnover in your district’s preschool? Was the means test threshold set too low? Did parents not want to provide income details for the means test?

el 11 years ago11 years ago

This is great news. In our state preschool, the fee has created turnover and disruption in the school, caused some kids not to enroll, and created administrative hassles for everyone.

Thanks for staying on this story, Lillian. 🙂

Paul 11 years ago11 years ago

Though everyone will 'feel good' when the preschool user fee is eliminated next year, the article exposes several systemic problems: 1. Unrealistic (dare I say greedy?) private social service providers receive baseline operating subsidies from the state but gripe about not getting to retain a small user fee that supports those very subsidies. I remember the case of a paratransit operator that had negotiated fee of $25 per trip (average trip length was 2 miles) from … Read More

Though everyone will ‘feel good’ when the preschool user fee is eliminated next year, the article exposes several systemic problems:

1. Unrealistic (dare I say greedy?) private social service providers receive baseline operating subsidies from the state but gripe about not getting to retain a small user fee that supports those very subsidies. I remember the case of a paratransit operator that had negotiated fee of $25 per trip (average trip length was 2 miles) from its local government sponsor. Later, the operator suggested that it also be allowed to keep the token $3 passenger fare (incidentally, capped by fedeal law, which creates a huge unfunded local mandate), instead of remiting this to the sponsor. In public testimony, the paratransit operator made it seem that the sponsor was stealing passengers’ fares, when in fact the money helped support the rather generous baseline subsidy. Social service providers need to understand that their direct revenue is separate from the government’s revenue, even if they are involved in collecting and remitting the latter.

2. Unrealistic (dare I say greedy?) parents don’t want to pay even a small user fee. The fee is means-tested, so what is the problem? The means test assures that bread isn’t being taken from the children’s or the parents’ mouths, or clothing, from their backs. Even though I support universal, high-quality preschool, with 100% taxpayer funding, California voters don’t agree with me, and this service has heretofore been the responsibility of parents, with limited government subsidies. Moreover, preschool is a totally predictable expense — predictable as to number of children, onset, duration, and monthly cost. If parents know that they will not be able to meet this expense, they should delay parenthood.

3. Cash-strapped local education agencies divert general fund revenue to make themselves look good. What has the ‘progressive’ school district mentioned in the article had to cut to be able to be able to afford not to collect this means-tested preschool user fee? Has anyone weighed the costs and benefits? Do we know whether this gift to preschool parents yields better educational outcomes than, say, an investment in K-12 math manipulatives or reading teachers or intervention classes or a restored professional development day? No, but it seemed like a really ‘nice’ thing to do.

Replies

el 11 years ago11 years ago

Paul, our local analysis was that billing and tracking these very small fees actually cost our district as much or more than they generated. That may not be true for larger districts.